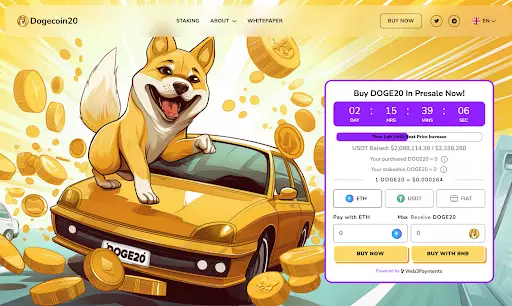

The cryptocurrency market has been abuzz with the recent success of Dogecoin20, a new meme coin that has raised $2 million in just four days. The allure of meme coins lies in their potential for high returns on investment, with Dogecoin20 offering the opportunity for 100x gains. However, a closer examination of Dogecoin20 reveals some concerning aspects that potential investors should be aware of.

While it is impressive that Dogecoin20 has raised $2 million in such a short period, the manner in which this funding was achieved raises some red flags. The rapid pace of fundraising, with the coin generating half a million dollars daily, could be seen as a cash grab rather than a legitimate investment opportunity. The urgency with which investors are encouraged to buy into the presale before the next price hike is also concerning, as it creates a sense of FOMO (fear of missing out) that may not be in the best interest of investors.

Dogecoin20 claims to be a reworking of the original Dogecoin, offering technical improvements such as proof-of-stake block verification and a staking option for passive income. While these improvements sound promising on the surface, it is essential to question whether they are genuine advancements or just a marketing gimmick to attract investors. The use of Ethereum smart contracts and the fixed supply of tokens are positive steps, but the real-world utility and sustainability of Dogecoin20 remain to be seen.

The success of Dogecoin20 can be attributed in part to the extensive media coverage it has received in reputable outlets such as Business Insider and Cointelegraph. However, media hype alone does not guarantee the long-term viability of a cryptocurrency. The influence of celebrities like Elon Musk, who have endorsed Dogecoin and other meme coins, adds to the speculative nature of these investments. Investors should be cautious not to conflate media attention with intrinsic value.

One of the key selling points of Dogecoin20 is its staking option, which allows token holders to earn passive income. The high staking rewards of 369% per annum may seem attractive, but the sustainability of such high returns is questionable. Additionally, the distribution of rewards to stakers raises concerns about token centralization and the concentration of wealth among a small number of holders.

While Dogecoin20 presents itself as a promising new meme coin with technical improvements and the potential for high returns, investors should approach with caution. The rapid fundraising pace, reliance on media hype, and questionable staking rewards raise doubts about the long-term viability of Dogecoin20. As with any investment, due diligence and careful consideration of the risks involved are essential to make an informed decision.