The crypto industry is on the verge of receiving greater clarity regarding regulatory oversight through new legislation set to potentially go to a House floor vote by the end of May. The Financial Innovation and Technology for the 21st Century (FIT21) Act is the proposed legislation aimed at providing transparent regulatory frameworks for digital assets. This legislation addresses longstanding issues of market oversight and consumer protection, marking a significant step towards regulating the rapidly expanding crypto ecosystem.

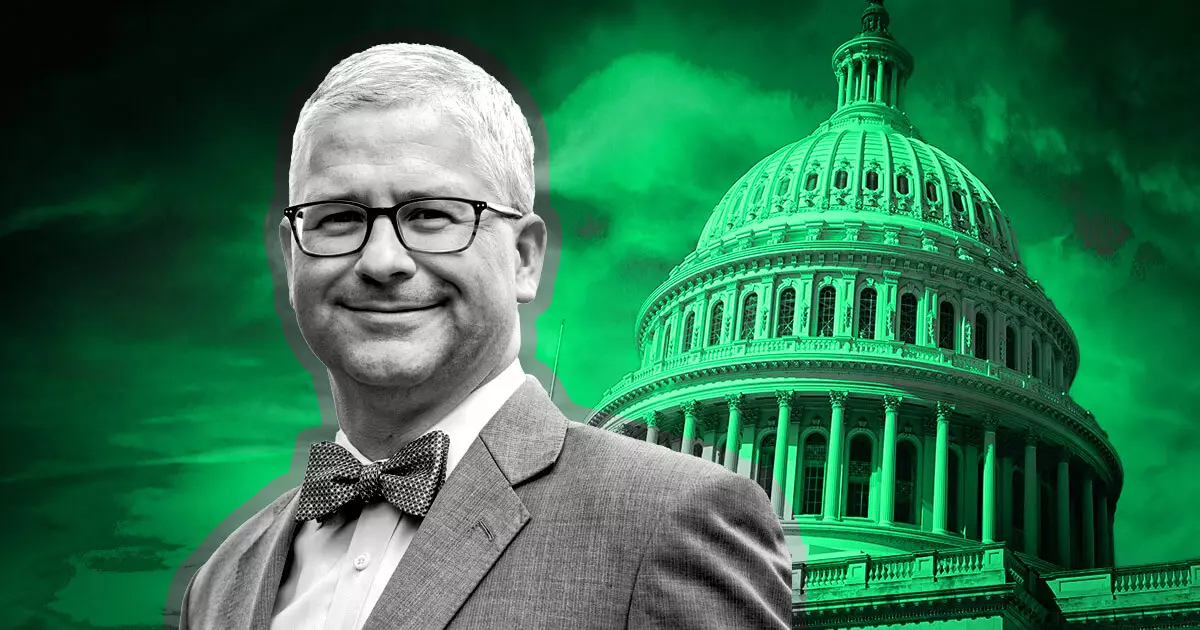

House Financial Services Committee Chairman Patrick McHenry emphasized the importance of the FIT21 Act in bringing an end to regulatory uncertainty that has hindered innovation and left consumers vulnerable within the U.S. digital asset ecosystem. The lack of clear guidelines has led to a stifling effect on the industry, limiting its growth potential and putting consumers at risk. The proposed legislation seeks to rectify these issues by establishing definitive regulations that will promote innovation while enhancing consumer protection measures.

Under the FIT21 Act, the Commodity Futures Trading Commission (CFTC) is granted jurisdiction over crypto commodities, while the Securities and Exchange Commission (SEC) is assigned jurisdiction over crypto offerings within investment contracts. This delineation of regulatory authority aims to establish clear lines between the two agencies, thereby reducing confusion and ensuring that crypto developers understand the regulatory framework they operate within. By separating the roles of the SEC and CFTC, the legislation offers clarity on compliance requirements, oversight responsibilities, and fund-raising activities within the crypto market.

Addressing Enforcement Controversies

The SEC’s enforcement efforts in the crypto space have faced criticism due to their perceived overreach and inconsistency. The FIT21 Act intends to address these controversies by providing clearer guidelines on the regulatory boundaries of the SEC, thereby reducing the likelihood of enforcement actions that are perceived as excessive or arbitrary. By creating a structured framework for regulatory oversight, the legislation aims to instill confidence in the market while fostering innovation and development within the crypto industry.

The proposed FIT21 Act represents a significant step towards providing much-needed clarity and regulatory certainty for the crypto industry. By establishing clear guidelines for market oversight and consumer protection, the legislation seeks to unlock the full potential of digital assets while safeguarding the interests of investors and consumers. With the potential for a House floor vote by the end of May, the crypto industry is on the cusp of a new era of regulatory transparency and accountability.