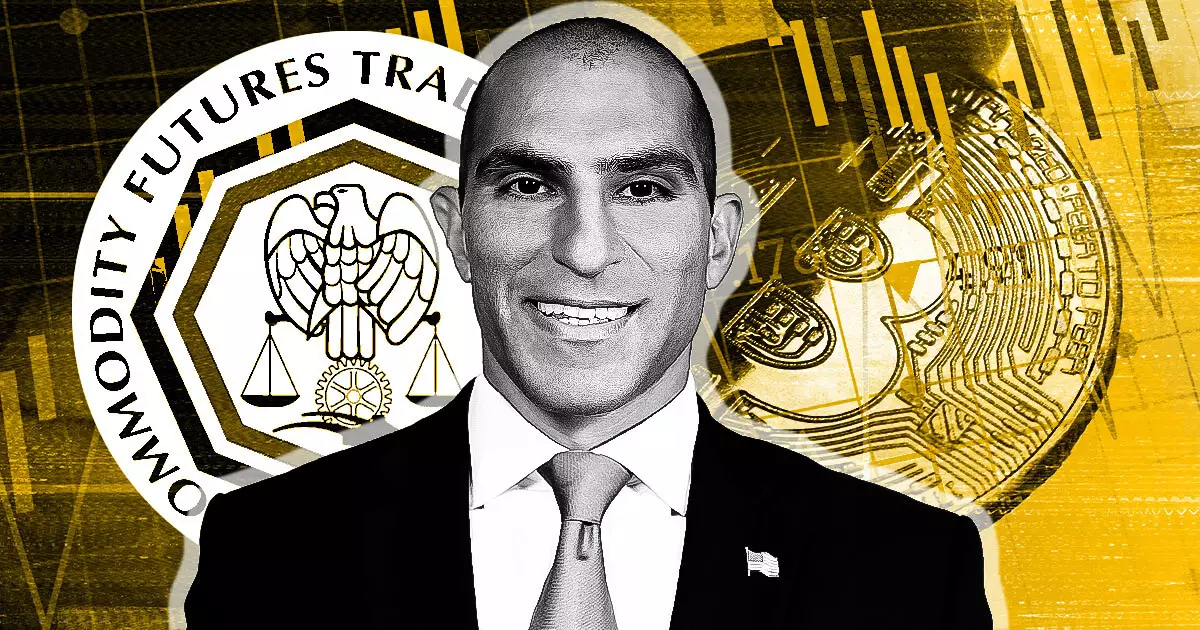

In a recent Senate Agriculture Committee hearing, CFTC chair Rostin Behnam expressed openness to the idea of the agency becoming a primary regulator for cryptocurrencies. This proposal, if implemented, would involve changes to the definitions of securities and commodities. Senator Roger Marshall suggested that the CFTC take on the role of primary regulator for digital assets, with the SEC handling only a few “offshoots.” Behnam agreed with this suggestion, emphasizing the CFTC’s capacity and expertise in this area.

Behnam also addressed concerns raised by Marshall regarding potential lawsuits stemming from conflicting asset designations. He highlighted the importance of cooperation between the CFTC and the SEC in addressing legal ambiguities. While Behnam acknowledged the possibility of lawsuits, he emphasized the need for a clear contract listing system that aligns with the powers of both agencies. This system, according to Behnam, would ensure a smooth and efficient listing process in regulated markets.

One of Behnam’s key priorities is to introduce tokens and contracts into regulated markets promptly to mitigate investor risks. He argued that a significant portion of the crypto market should fall under the CFTC’s jurisdiction, as many assets cannot be categorized as securities. Behnam estimated that 70% to 80% of the crypto market lacks direct federal oversight, underscoring the need for the CFTC to play a more active role in this space.

Behnam highlighted the financial requirements for establishing a regulatory regime for crypto assets. He stated that the CFTC would need at least $30 million in the first year and $50 million in the second year to support staffing, administration, and IT expenses. Behnam proposed that user fees collected from registrants could help offset these costs. Additionally, he echoed Senator Cory Booker’s concerns about the urgency of granting the CFTC more regulatory authority to combat fraud and manipulation in the cryptocurrency market.

Overall, Behnam’s testimony underscored the CFTC’s willingness to expand its role in regulating crypto assets and its commitment to enhancing investor protection. By advocating for a collaborative approach with the SEC and emphasizing the need for adequate funding, Behnam articulated a vision for a more robust regulatory framework for digital commodities. As the crypto market continues to evolve, the CFTC’s role in overseeing this space will be crucial in safeguarding market integrity and investor interests.