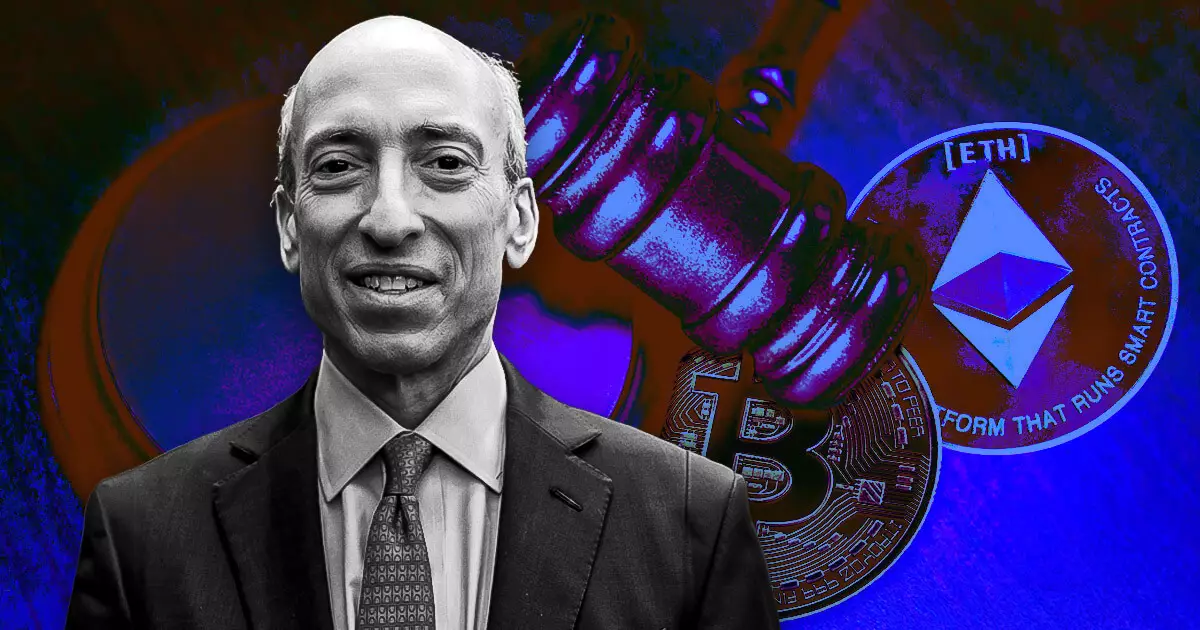

During a hearing on July 11, Judge Katherine Polk Failla expressed her disapproval of Coinbase’s attempts to subpoena SEC chair Gary Gensler in the ongoing case against the firm. Failla specifically pointed out that the request included Gensler’s statements before he assumed his role as SEC chair in 2021. Coinbase’s lawyer argued that the company needed access to Gensler’s earliest comments due to concerns about his use of personal devices or email accounts for discussing crypto or interacting with market participants. However, Failla found Coinbase’s arguments to be speculative and unpersuasive. She highlighted the difficulty in obtaining Gensler’s pre-chair statements, questioning the necessity of such an inquiry.

Despite her criticisms, Judge Failla did acknowledge Coinbase’s concerns during the hearing. She admitted that she was troubled by the possibility that the company had been facing obstacles in obtaining information. Failla also stated her expectation of future motions from Coinbase, indicating that she would be attentive to any further developments in the case. The judge’s comments reflected a nuanced approach to balancing the interests of both parties involved in the legal proceedings.

SEC lawyer Jorge Tenreiro joined Failla in criticizing Coinbase’s subpoena request, describing it as “incredibly intrusive” towards a public official. He emphasized that the focus of the case should be on the SEC’s actions rather than Gensler’s personal communications. Tenreiro argued that Gensler was neither a fact witness nor an expert witness on the law, urging the court to reject Coinbase’s demands for his pre-chair statements. Failla agreed with the concerns raised by Tenreiro, underlining the disproportionate burden of inquiry into Gensler’s past remarks.

Coinbase’s legal team referenced the SEC’s handling of the case against Ripple, where the court ordered the discovery of multiple custodians, including then-SEC chair Jay Clayton. However, Tenreiro countered this argument by highlighting the SEC’s efforts to restrict Ripple’s access to certain information, including searches of SEC staff’s personal devices. The comparison with the Ripple case provided valuable context for understanding the complexities of subpoena requests in high-profile legal disputes involving regulatory agencies like the SEC.

The back-and-forth between Coinbase and the SEC underscored the contentious nature of the lawsuit initiated by the regulatory body. Coinbase’s request for documents and communications related to Gensler’s public statements on digital assets, platforms, and staking revealed the company’s strategy for building its defense. The SEC’s resistance to sharing specific information indicated its commitment to upholding its regulatory mandate while also safeguarding the privacy of its officials. The ongoing dispute highlighted the challenges inherent in navigating legal proceedings involving complex financial regulations and digital assets.

The efforts to subpoena SEC chair Gary Gensler in the Coinbase case have faced significant pushback from both Judge Katherine Polk Failla and SEC lawyer Jorge Tenreiro. The tensions surrounding the request for Gensler’s pre-chair statements have brought to light the complexities of legal proceedings involving major cryptocurrency exchanges and regulatory agencies like the SEC. As the case continues to unfold, it remains to be seen how the courts will reconcile the competing interests of all parties involved and reach a fair resolution.