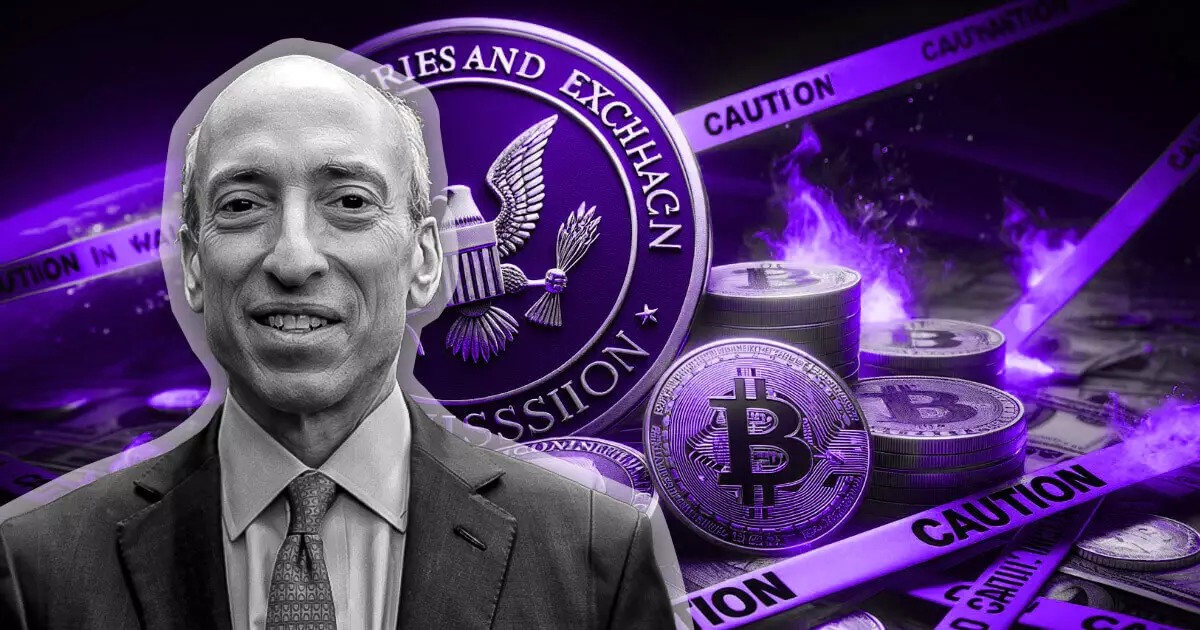

In a recent interview on CNBC, Gary Gensler, Chair of the U.S. Securities and Exchange Commission (SEC), asserted that Bitcoin is not a security, reinforcing the stance taken by prior SEC leadership. This distinction is vital amid ongoing debates regarding how cryptocurrencies fit within existing regulatory frameworks. Gensler emphasized that Bitcoin is classified as a commodity, and this categorization is important for its legitimacy in the financial markets. His statements come at a time when several spot Bitcoin exchange-traded funds (ETFs) have gained approval, allowing Bitcoin to be traded on high-profile American exchanges like Nasdaq.

The significance of this classification cannot be overstated. By designating Bitcoin as a commodity, it provides a more stable regulatory environment for its investors and traders. However, Gensler was quick to point out the broader issues plaguing the cryptocurrency sector, including non-compliance with existing regulations. He alleged that a substantial portion of market participants are neglecting established rules and seeking undue exemptions, leading to market confusion and instability.

The Uncertain Status of Ethereum

In stark contrast to Bitcoin’s clear regulatory status, Ethereum currently navigates a murky legal landscape. The SEC has yet to formally designate Ethereum as either a security or a non-security, contributing to an ongoing environment of uncertainty for developers and investors alike. This lack of clarity has implications for numerous projects built on Ethereum’s blockchain, which are now subject to scrutiny amid investigations of companies like Consensys and Uniswap.

The SEC’s selective enforcement and ambiguity surrounding Ethereum have raised eyebrows among U.S. lawmakers. Several members of Congress have criticized Gensler for introducing vague terminology such as “crypto asset security,” complicating the regulatory dialogue. Critics argue that the agency’s approach may stifle innovation instead of fostering a sustainable growth environment for cryptocurrencies. In recent congressional hearings, frustration was evident, with lawmakers voicing concerns that the SEC has not only lacked clarity but also failed to empower developers within the crypto space.

Calls for a Comprehensive Regulatory Framework

Despite the backlash, Gensler remains resolute about the necessity of comprehensive regulatory frameworks for cryptocurrency markets. He believes that the success of this burgeoning sector hinges on robust regulations designed to protect investors and bolster market integrity. In his view, establishing trust in digital assets is akin to implementing traffic regulations; without some form of oversight, the industry may not be sustainable in the long run.

This sentiment resonates with other SEC commissioners, including Hester Peirce and Mark Uyeda, who have echoed concerns regarding the agency’s current strategy. They argue that a lack of clear guidelines has left market participants operating in a state of confusion, raising questions about the SEC’s use of its regulatory authority.

The regulatory future for cryptocurrencies remains fraught with challenges. While Bitcoin enjoys a definitive status as a commodity under U.S. law, the ambiguity surrounding Ethereum and other digital assets leaves much to be desired. As the regulatory landscape evolves, the conversations surrounding compliance, investor protection, and innovation will likely shape the trajectory of the cryptocurrency market for years to come.