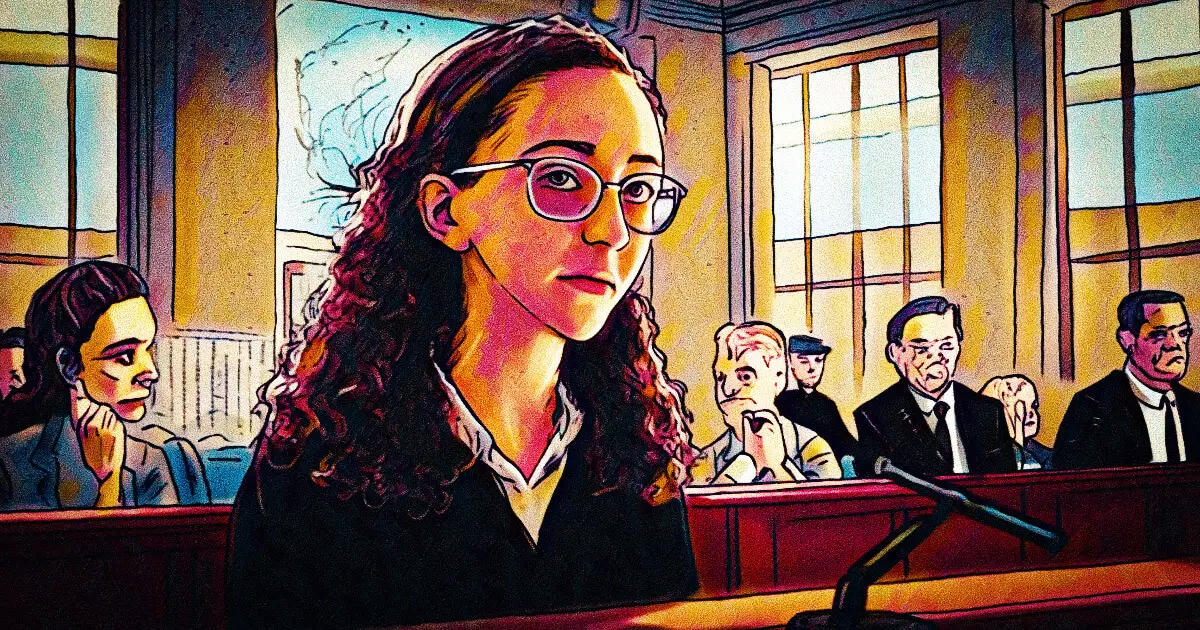

The downfall of FTX, once a leading cryptocurrency exchange, was marked by scandal, mismanagement, and intricate personal dynamics among its executives. At the center of this storm was Caroline Ellison, the former CEO of Alameda Research, who now faces a stark consequence for her actions: a two-year prison sentence and the forfeiture of $11 billion. This narrative is not merely about punishment but also highlights critical themes of accountability, cooperation, and the human factors that contribute to corporate failures.

Ellison’s Role and Cooperation

Ellison’s involvement in the FTX scandal showcases an intricate blend of personal relationships and professional responsibilities. As the ex-girlfriend of Sam Bankman-Fried (SBF), Ellison’s legal counsel sought to emphasize her cooperation with federal authorities as a mitigating factor in her sentencing. They argued that her testimony had a significant influence on securing SBF’s conviction for fraud. The claim that her cooperation was pivotal in asset recovery underscores a critical aspect of legal accountability within corporate governance. Did Ellison act out of genuine remorse, or was her cooperation a strategic move to mitigate her own legal repercussions?

The courtroom strategies employed by her legal team reveal another layer of the narrative. By attempting to present her as a victim of SBF’s manipulative tendencies, they aimed to portray her as a person tangled in a web of moral ambiguity rather than a key perpetrator of fraud. Nevertheless, her acceptance of a plea deal highlights a recognition of her participation in wrongful activities, complicating the narrative of innocence.

The Aftermath: Broader Implications for the Crypto Industry

Ellison’s sentencing is emblematic of the broader legal ramifications faced by top executives in the cryptocurrency space following the FTX collapse. This incident serves as a wake-up call for the crypto industry, which has been characterized by a lack of regulation and oversight. The sentencing of other executives, such as Ryan Salame and the pending fates of Nishad Singh and Gary Wang, illustrates a concerted effort by authorities to hold individuals accountable, thereby reinforcing the need for ethical standards within innovative yet volatile markets.

Moreover, the case has sparked discussions around the power dynamics at play in high-stakes financial operations. Leaders in such environments often wield significant influence, and when personal relationships complicate professional decisions, the potential for ethical breaches increases. As cryptocurrency continues to gain prominence, the inherent risks associated with its one-time unregulated status warrant scrutiny and reform.

Caroline Ellison’s story is a cautionary tale, not just about individual accountability, but also about the collective responsibility of leaders in the digital finance space. As the cryptocurrency landscape evolves, it is essential that new standards of governance, transparency, and ethical conduct are established to prevent similar collapses in the future. The legal actions taken against Ellison and her former colleagues serve as a testament to the complexities of justice in a rapidly changing industry, highlighting the need for a balance between innovation and ethical responsibility. As we move forward, the hope is that this chapter in crypto history will foster a culture where integrity takes precedence over ambition, creating a more robust and sustainable industry for the future.