The ongoing conflict between the Securities and Exchange Commission (SEC) and Ripple Labs regarding the status of XRP has captured the attention of the cryptocurrency community and financial regulators alike. The SEC initiated legal proceedings against Ripple in December 2020, accusing the company of executing an unregistered securities offering totaling $1.3 billion through the sale of XRP. Central to this lawsuit is the classification of XRP—whether it should be classified as a security, thereby falling under the SEC’s regulatory purview, or as a utility token. This case exemplifies significant friction within the financial regulatory landscape and underscores the evolving discussion surrounding crypto asset classification.

In August 2023, a pivotal ruling from U.S. District Judge Analisa Torres rendered a mixed verdict. While the court sided with Ripple in asserting that programmatic sales of XRP to retail investors did not breach securities laws, it simultaneously found that Ripple’s direct sales to institutional investors valued at $728 million did constitute unregistered securities sales. This latter finding warranted a sizeable penalty of $125 million against Ripple, which, although substantial, was significantly lower than the originally sought $2 billion. This mixed ruling left stakeholders in the XRP ecosystem with conflicting sentiments: a partial victory heralded for retail investors juxtaposed with a lingering burden for direct institutional transactions.

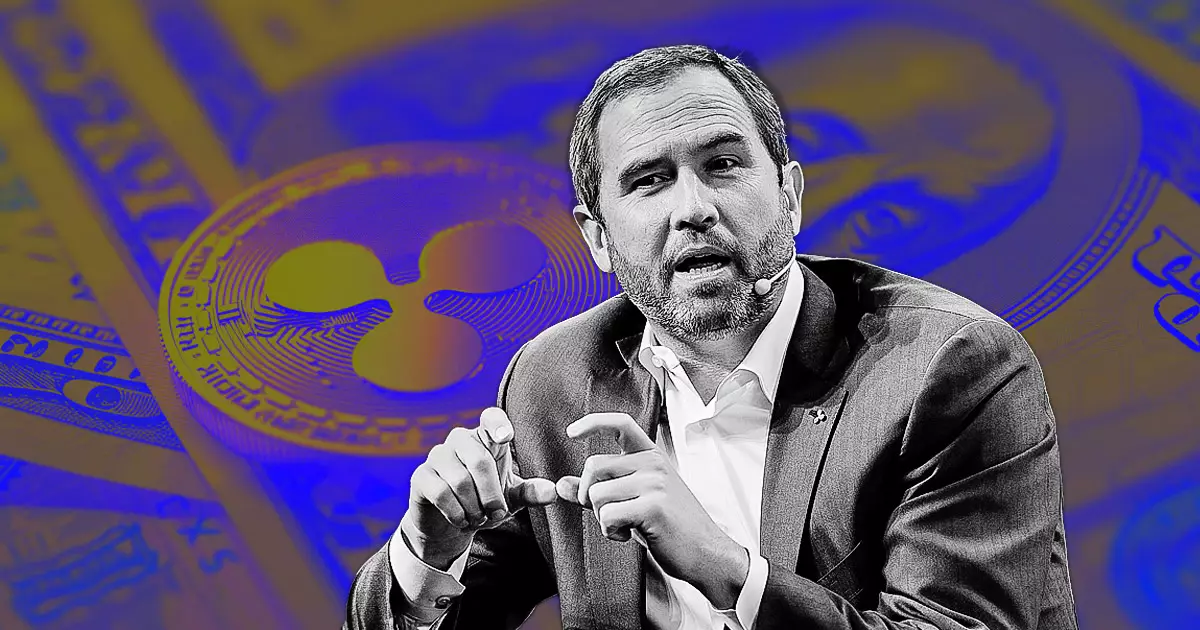

On October 2, 2023, the SEC announced its intention to appeal this decision, rekindling tensions between the regulatory body and Ripple Labs. The agency’s appeal reflects its assertion that the court’s ruling contradicts longstanding Supreme Court precedents. Ripple’s executive leadership, including CEO Brad Garlinghouse and Chief Legal Officer Stuart Alderoty, expressed dismay over the SEC’s decision, arguing that it exemplifies a misuse of taxpayer resources and an unnecessary prolongation of what many consider a settled matter—especially concerning XRP’s classification as a non-security.

The ramifications of the SEC’s appeal extend beyond Ripple, impacting the larger cryptocurrency landscape. Ripple’s case has become emblematic of the broader struggle for regulatory clarity in the crypto industry. As Garlinghouse articulated, the SEC’s persistent opposition underscores a troubling trend wherein regulatory bodies can exercise unchecked power, potentially stifling innovation in the crypto space.

The news of the SEC’s appeal prompted an immediate negative reaction in the XRP market. Within 24 hours following the announcement, XRP experienced an approximately 9% decline, falling slightly above $0.54. Market reactions often serve as a litmus test for investor confidence and sentiment about regulatory outcomes. The decline in XRP’s value indicates that many market participants anticipated adverse consequences resulting from the SEC’s move, showcasing how intertwined regulatory decisions are with market performance.

Moreover, XRP’s liquidity was significantly tested, with its trading volume hovering around $2.54 billion at the time of the report. This suggests that traders are closely monitoring the situation, making adjustments reflective of perceived risks related to the outcome of the appeal. Conclusively, the volatile nature of cryptocurrency assets responds acutely to regulatory developments, underscoring the crucial need for transparent frameworks governing digital currencies.

Ripple’s ongoing legal battle has elevated the stakes for other firms operating within the crypto space. Many industry players now look to Ripple’s case as a potential turning point that could affect how various digital assets are regulated in the future. Alderoty’s observation that the court determined there were “no victims or losses” brings to light an essential consideration regarding regulatory frameworks and their implications for innovation.

As the crypto industry stands at a crossroads, the outcome of the SEC’s appeal could set a precedent for future regulatory actions. If Ripple manages to prevail, it may embolden other companies to challenge the SEC’s regulatory approach, possibly leading to more hostile engagement between regulators and innovators. Conversely, if the SEC succeeds in its appeal, it could signal a more stringent regulatory environment that may stifle creativity and growth within the burgeoning crypto market.

The SEC’s appeal against Ripple Labs represents not only a critical moment for the companies involved but also a broader indicator of the regulatory future of the cryptocurrency market. The evolving dynamics will continue to shape how digital assets are defined and regulated, influencing market behavior and innovation trajectories across the industry.