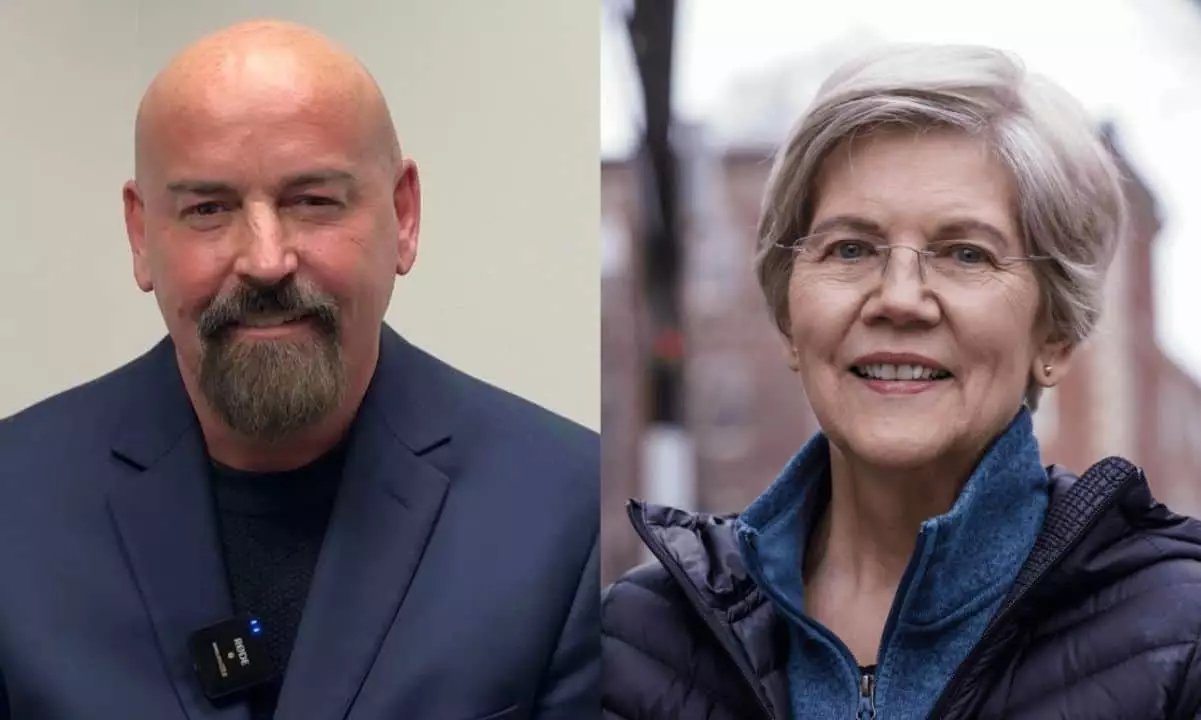

The recent debate between Massachusetts Senator Elizabeth Warren and her opponent, John Deaton, has sparked significant conversation in the political and financial landscapes. This confrontation illuminated their fundamentally divergent perspectives on digital assets and set the stage for a broader discourse on the role of cryptocurrencies in our economy. With Warren’s established reputation as a vehement critic of digital currencies, and Deaton’s rise as a champion for crypto enthusiasts, the debate promised to be both revealing and contentious.

Warren initiated the discussion with a pointed accusation against Deaton, insinuating that his potential victory could turn him into a representative primarily for the interests of the crypto industry, rather than the constituents he aims to serve. This concern resonates with many voters who worry about the influence of financial interests in political decision-making processes. Deaton, however, seized this allegation as an opportunity to share his vision of cryptocurrency as a vital tool for financial inclusivity, presenting it as a means to empower those who find themselves marginalized by traditional financial systems.

Underlying Narratives of Financial Inclusion

The crux of Deaton’s argument hinges on the transformative potential of cryptocurrency. He introduced a poignant anecdote involving his mother, who faced considerable difficulties due to predatory fees imposed by conventional banking institutions. This personal narrative served as a powerful illustration of how digital currencies can provide alternative economic pathways for underserved populations. Deaton advocated for a more nuanced understanding of cryptocurrencies, positing that they could alleviate financial burdens for those trapped in a cycle of debt perpetuated by traditional banks.

His critique of Warren’s focus on cryptocurrency without addressing broader economic issues such as inflation painted her as somewhat out of touch with the pressing concerns of everyday Americans. By cleverly referencing her commitment to combating inflation, Deaton challenged Warren’s emphasis on regulating digital assets, suggesting a disproportionate focus on crypto that neglects other critical areas affecting constituents’ lives.

As the debate escalated, Warren pointed fingers at Deaton, highlighting the significant financial backing he received from the cryptocurrency sector. This line of attack aimed to question Deaton’s integrity and suggest that he would prioritize the interests of wealthy donors over those of ordinary citizens. Warren’s assertion that Deaton’s financial support came almost entirely from the crypto industry effectively painted him as a candidate aligned with elite interests rather than grassroots concerns.

Deaton countered by exposing the hypocrisy in Warren’s claims, referencing her own connections with corporate PACs and interest groups. This maneuver offered a glimpse into the complex interplay of money and politics, reminding viewers that such connections exist on both sides of the aisle. He also brought to light his involvement in the Ripple v. SEC lawsuit, emphasizing his commitment to fighting against what he perceives as overreaching regulatory measures that hinder industry progress.

Warren’s steadfast position is rooted in the belief that cryptocurrencies pose serious risks to consumers and the financial system at large. She expressed apprehensions about potential illegal activities facilitated by these digital assets, framing her campaign as a necessary push for regulatory oversight to protect everyday Americans. Her insistence that “crypto must play by the same rules as banks and credit unions” reflects a traditional view of financial regulations, seeking to extend existing frameworks to these novel technologies.

In stark contrast, Deaton’s argument against Warren’s regulatory stance resonated with many in the crypto community. He argued that her proposed regulations favored large financial entities while potentially disenfranchising average individuals seeking autonomy over their finances. By advocating for individual self-custody, he underscored a fundamental tenet of cryptocurrency: the empowerment of individuals through decentralized finance, an ethos that is at odds with Warren’s regulatory framework.

The debate between Warren and Deaton not only showcased the stark differences in their approaches to cryptocurrency but highlighted larger ideological divides regarding regulation, financial inclusion, and the power dynamics inherent in these discussions. As the political landscape continues to evolve, the implications of their exchange are likely to reverberate through future policy discussions and electoral races. The dialogue surrounding cryptocurrencies is far from settled, and as these debates unfold, they will inevitably shape both the future of finance and the broader political discourse.