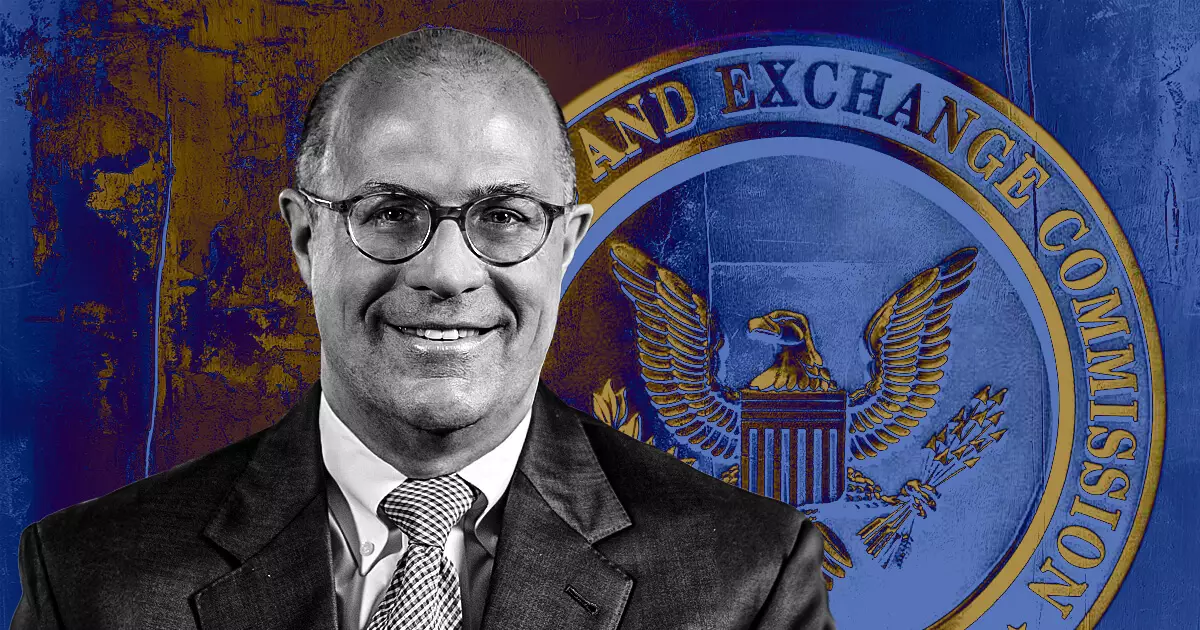

The world of cryptocurrency regulation is fraught with speculation and uncertainty, particularly with individuals who have significant influence over the regulatory landscape. Former Chair of the Commodity Futures Trading Commission (CFTC), Christopher Giancarlo, has recently found himself at the center of such speculation. Giancarlo firmly rejected rumors suggesting he was being considered for the top position at the Securities and Exchange Commission (SEC) or even a crypto-related role within the US Treasury Department. He stated unequivocally, “I’ve made clear that I’ve already cleaned up earlier Gary Gensler mess [at] CFTC and don’t want to have to do it again.” This comment raises intriguing questions about the state of regulatory affairs under current SEC Chair Gary Gensler.

The “mess” Giancarlo alluded to likely pertains to what many insiders criticize as the SEC’s “regulation by enforcement” methodology, particularly regarding cryptocurrencies. This approach has led to significant backlash from various stakeholders, including industry giants and legal experts alike. Many argue that the SEC’s aggressive litigation strategy, aimed at firms such as Kraken and Binance, lacks the framework for clear regulations and only serves to muddy the waters further for an already complex industry.

The SEC’s treatment of cryptocurrencies has increasingly come under fire, with some officials labeling the current approach a “disaster.” Critics suggest that a more defined regulatory framework is essential for fostering growth and stability in the crypto sector. As this debate continues, Giancarlo’s historical perspective as a progressive regulator—affectionately nicknamed “Crypto Dad”—positions him as a crucial voice in advocating for a more balanced regulatory approach that encourages innovation while still protecting investors.

Current SEC Chair Gary Gensler recently elaborated on the commission’s perspective during a major conference, emphasizing that, despite Bitcoin’s non-security status, a significant number of the over 10,000 digital assets in circulation are, in fact, securities. Gensler argues that regulatory oversight is essential to safeguard investors from potential harm, especially in an environment characterized by dubious digital assets lacking transparency and stability.

This contrasting approach from Giancarlo and Gensler speaks volumes about the broader dilemma facing the US financial regulatory framework. While Gensler’s stance seeks to enforce rigorous controls, Giancarlo advocates for a nuanced approach that respects the innovative spirit of cryptocurrencies. This dichotomy encapsulates the challenges regulators face in balancing the promotion of technological progress with the imperative of protecting investors—a balance that remains precarious in the rapidly evolving crypto landscape.

As discussions around the future of cryptocurrency regulation continue to unfold, the contrasts between Giancarlo’s and Gensler’s perspectives underscore a growing rift that could influence the trajectory of the crypto industry. Stakeholders are left to grapple with the implications of these regulatory approaches, both of which are rooted in a desire to foster a secure financial environment. With Giancarlo currently advising the US Digital Chamber of Commerce and Gensler at the helm of the SEC, the ongoing dialogue will undoubtedly shape the future regulatory framework of this dynamic sector. The ultimate question remains: can regulatory clarity and innovation coexist in the world of cryptocurrency? As of now, the answer remains uncertain.