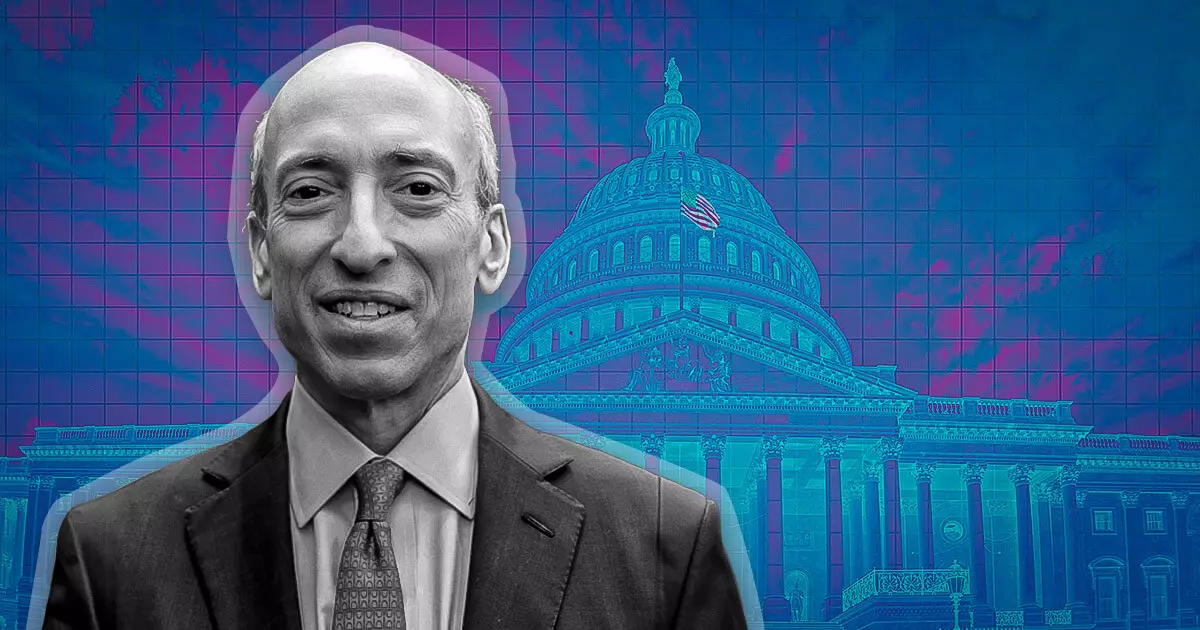

The actions of Gary Gensler, chair of the U.S. Securities and Exchange Commission (SEC), have ignited a firestorm of criticism from various quarters, most notably from Tyler Winklevoss, co-founder of the cryptocurrency exchange Gemini. Winklevoss asserts that Gensler’s decisions cannot simply be dismissed as mistakes made in good faith, but rather are calculated moves driven by a personal agenda. Such accusations raise important questions about the integrity and motivations of regulatory bodies, especially in emerging sectors like cryptocurrency.

In his scathing commentary, Winklevoss categorizes Gensler’s actions as “entirely thought out” and “purposeful,” accusing him of prioritizing his political ambitions over the welfare of the cryptocurrency industry. This sentiment taps into a growing concern among many stakeholders, who feel that oversight bodies, rather than being protectors of innovation and financial integrity, have turned into obstacles that stifle progress. Winklevoss argues that Gensler’s regulatory approach could potentially decimate the burgeoning crypto sector, jeopardizing jobs, investments, and the livelihoods of thousands.

Winklevoss’s criticism resonates with a larger narrative surrounding regulatory overreach, particularly concerning innovations in finance. As technology-driven financial solutions emerge, the resonance between regulation and innovation becomes increasingly delicate. Gensler’s stance—arguably one of stringent enforcement—has been perceived by many as not only damaging but also counterproductive. It raises essential considerations about how regulatory authorities can equip themselves to accommodate innovation while safeguarding investors.

The fallout from Gensler’s approach has provoked considerable unrest not just within the cryptocurrency industry, but across a broader spectrum of American industries. Winklevoss controversially labelled Gensler as “evil,” suggesting that his decisions were not merely bureaucratic blunders, but conscious actions leading to substantive harm within the crypto community. This stark language highlights the depth of frustration among industry advocates who believe that regulatory frameworks should evolve alongside financial innovations rather than impede them.

Winklevoss doesn’t stop at mere critique; he calls for a complete ban on Gensler’s re-employment within any institution that values integrity in the crypto landscape. He warns that allowing Gensler to wield influence again would represent a betrayal to the values of transparency and innovation. This point underscores an urgent need for accountability mechanisms in regulatory practices—especially when the negative consequences are palpable and enduring.

Political Backlash and Broader Concerns of Regulatory Overreach

Winklevoss’s allegations are compounded by a lawsuit from eighteen U.S. states against the SEC, accusing it of “gross government overreach.” This development signals a growing bipartisan concern about the SEC’s balance of power and effectiveness. In an age where innovation continuously reshapes the financial landscape, can regulatory bodies keep pace without resorting to overbearing tactics? The tension between innovation and regulation may lead to larger discussions about how governmental agencies can optimize their frameworks to be more adaptive to the needs of emerging sectors.

The political implications are also profound. Donald Trump’s pledge to fire Gensler upon returning to the presidency reflects a populist sentiment that resonates with many frustrated by what they perceive as a government that has strayed into inefficient and harmful regulatory territory. Although the president lacks the authority to remove the SEC chair, this sentiment fosters a climate of accountability and scrutiny that could shape future governance.

The controversy surrounding Gary Gensler is emblematic of a critical juncture in financial regulation. Tyler Winklevoss’s strong denunciation reflects a broader reckoning with oversight that needs to be more considerate of innovation while still protecting market integrity. As regulatory frameworks continue to evolve, a delicate balance must be achieved—one that fosters growth without leaving room for detrimental overreach. It’s a dialogue that is far from over, and all stakeholders must engage in order to shape a future where financial innovation can flourish responsibly.