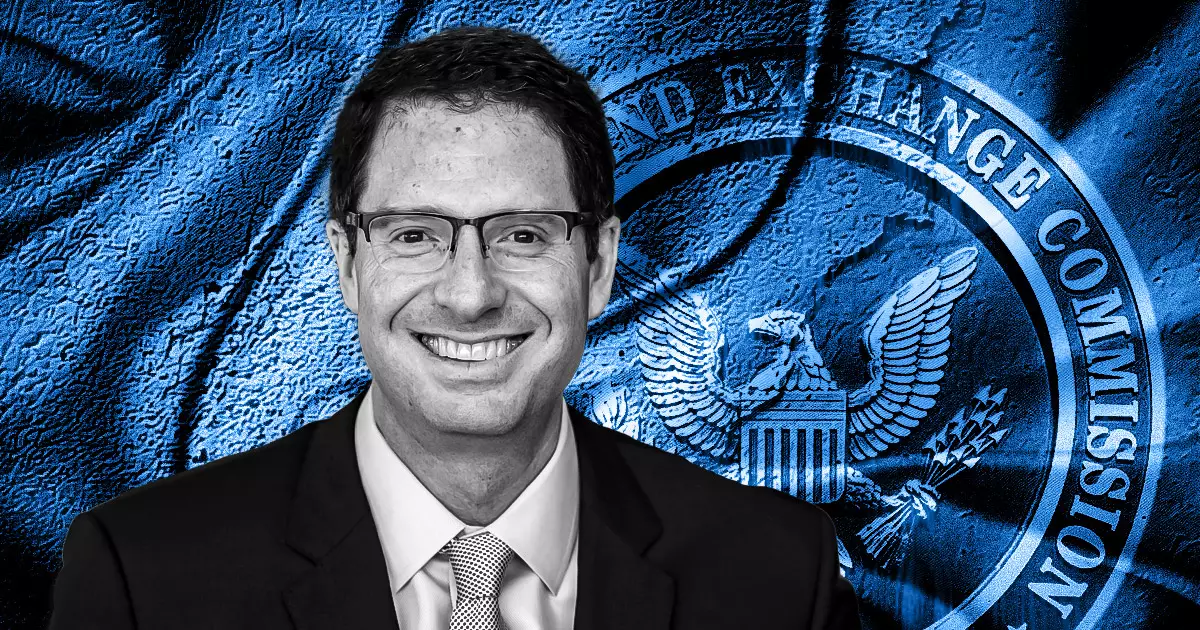

In a notable display of support within the cryptocurrency realm, Jesse Powell, the CEO and founder of the Kraken crypto exchange, has publicly backed Brian Brooks as a strong candidate for the role of Chair of the Securities and Exchange Commission (SEC). This endorsement, articulated through a recent post on social media platform X, underscores Powell’s belief in Brooks’ extensive experience, which spans beyond just cryptocurrency to encompass crucial aspects of the SEC’s regulatory framework. Powell expressed concern that under its current direction, the SEC has strayed from its foundational responsibilities, adversely affecting U.S. businesses and the broader market landscape.

As Brooks’ name surfaces among various potential candidates to lead the SEC, it is essential to understand the context of this regulatory environment. According to Fox Business reporter Eleanor Terrett, Brooks’ expertise is being considered for a plethora of financial oversight roles, including positions at the Federal Deposit Insurance Corporation (FDIC) and the Financial Industry Regulatory Authority (FINRA). This interest in Brooks is fueled by uncertainty surrounding the future leadership at the SEC following Gary Gensler’s anticipated departure. Other candidates in the fray include familiar faces such as Dan Gallagher from Robinhood and the SEC’s own Hester Peirce, often dubbed “Crypto Mom,” highlighting the varied perspectives vying for this influential role.

Brooks himself has been forthcoming about the critical groundwork that the next SEC Chair, particularly under a future Trump administration, will inherit. He reminds stakeholders of initiatives from Trump’s first term, which laid a foundation for digital asset custody and regulatory clarity regarding stablecoin reserves. These advancements not only recognized the legitimacy of decentralized systems but also fostered an environment for innovation and regulatory evolution within the cryptocurrency sector.

Under Brooks’ leadership, the SEC could enhance its mission by nurturing the growth of emerging technologies and refining clarity around digital assets. Powell’s endorsement reflects a broader sentiment in the crypto community—one that advocates for regulatory frameworks that do not stifle innovation but rather facilitate it.

While support for Brooks is evident, the probability metrics tell a nuanced story. Current prediction markets on Kalshi assign Brooks a mere 16% chance of attaining the SEC Chair position, relegating him to a low-ranking status among other contenders. This statistic prompts a deeper examination into the decision-making processes within the regulatory apparatus and illuminates the challenges Brooks may face in achieving this significant role.

The upcoming leadership of the SEC harbors immense implications for the future of the cryptocurrency industry and financial regulation as a whole. Jesse Powell’s advocacy for Brian Brooks highlights a crucial dialogue surrounding the necessity of capable leaders who can balance regulatory oversight with the need for innovation in an evolving financial landscape. As the conversation continues, stakeholders will be watching closely to see who will take the helm and guide the future of financial regulation in the U.S.