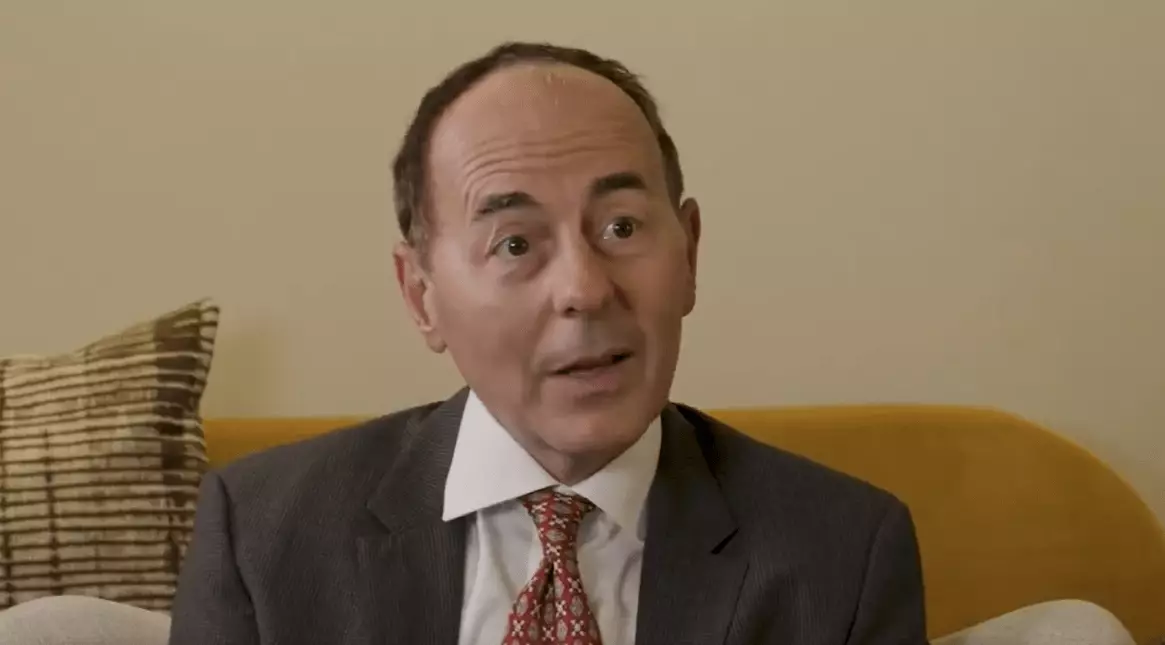

In a recent discussion with Mario Nawfal, Jan van Eck, the Chief Executive Officer of the globally recognized asset management firm VanEck, provided a nuanced perspective on the trajectory of Bitcoin amidst broader economic concerns. With an impressive portfolio of $118 billion managed, van Eck’s insights carry significant weight in the ongoing dialogue about cryptocurrency and financial markets. This article seeks to delve into van Eck’s outlook on Bitcoin, the startling reality of the U.S. fiscal deficit, and the consequent implications for investors.

Van Eck’s optimism about Bitcoin is apparent but is tempered with caution. While many cryptocurrency advocates project astronomical price points, van Eck predicts a more conservative trajectory. He identifies a price target for this bull run, estimating Bitcoin’s value could reach between $150,000 and $180,000, emphasizing the importance of the asset’s halving cycle. His skepticism towards the much-hyped figure of $400,000 reflects a thoughtful analysis rather than baseless speculation. Van Eck believes that this ceiling could potentially be breached in the next cycle, aligning with the notion of Bitcoin being valued at half of gold’s price. This suggests a measured, methodical approach to investing in Bitcoin, underscoring the notion that unrealistic expectations can lead to detrimental financial decisions.

Shifting focus from cryptocurrencies to the fiscal landscape, van Eck bluntly refers to the U.S. fiscal deficit as “the elephant in the room.” His assertion raises alarms about the sustainability of current spending practices. With a deficit totaling around $1.8 trillion last year, van Eck describes the situation as perilous, akin to financial mismanagement that could lead any other nation towards insolvency. He elaborates on two predominant attitudes within Washington: the lobbyist perspective that dismisses significant spending cuts and the radical approach that seeks billions in governmental reductions. He elaborates on this “extreme disruptor” stance, highlighting recommendations for cuts that could eradicate redundant spending programs—an optimistic yet plausible vision of a healthier fiscal future.

Van Eck’s observations extend to the political landscape, particularly in the wake of the Trump administration. He notes a peculiar uncertainty around fiscal policies despite a unified political party’s electoral success. Recognizing that the market’s initial reaction favored declines in gold underlines the intricate relationship between political change and market expectations. He speculates that initial apprehensions regarding government restructuring contributed to this ambivalence.

Such continuing uncertainty puts professional investors in a conundrum as they navigate fiscal landscapes that are unpredictable at best. This volatility often leads to a status quo where many investors opt to maintain their current strategies until a clearer path emerges.

In addition to fiscal concerns, van Eck draws attention to the unpredictable nature of geopolitical issues, exemplified by the conflict in Ukraine. He articulates the inherent difficulties in investing amid shifting global sands, acknowledging that such factors are often beyond the predictable scope of market analysis. The unpredictability here can lead to uneasy investor sentiment, where many professionals prefer to remain passive rather than react impulsively based on headlines.

Investors who sit still during geopolitical turmoil might miss opportunities but also shield themselves from unnecessary risks. As van Eck rightly points out, the potential for sudden, unexpected events complicates the landscape, affecting both Bitcoin and broader financial markets.

With respect to the institutional interest that Bitcoin is garnering, van Eck notes a pivotal element: the regulatory environment. He suggests that while Southeast Asia has embraced cryptocurrency with open arms, the regulatory climate in the U.S. has lagged. However, he observes a newfound interest from institutional actors, signifying a potential shift in how Bitcoin may be received by the financial community.

Van Eck expresses his own confidence by acknowledging significant personal investments in Bitcoin and gold. He analogizes Bitcoin to a maturing teenager, suggesting the need for new types of investors to accelerate its evolution into a mainstream asset.

Jan van Eck’s insights underscore a critical period in both cryptocurrency and broader financial markets. His cautious but optimistic projections for Bitcoin, combined with an urgent call to recognize the implications of fiscal policy, traffic in an environment of uncertainty. As both institutional and individual investors brace for the upcoming cycles, van Eck’s analysis serves as a wake-up call: prudent strategies rooted in analysis, vigilance against volatility, and an understanding of the interplay between geopolitical affairs and economic indicators will be essential for navigating this complex landscape.