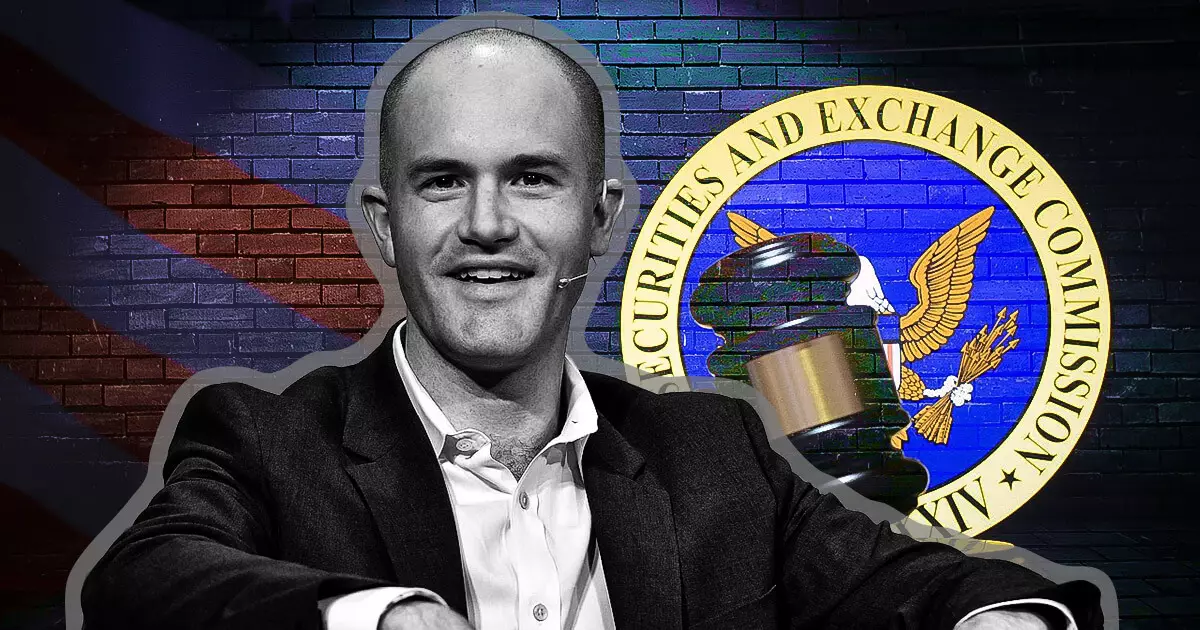

In a decisive move that underscores the shifting dynamics between cryptocurrency exchanges and regulatory bodies, Coinbase CEO Brian Armstrong has declared that the platform will no longer partner with law firms that engage former regulatory officials whose actions he deems “unlawful.” Armstrong’s remarks, made on December 3, reflect an intense frustration that has been building within the crypto community, particularly towards regulatory figures perceived as having imposed heavy-handed measures against digital assets. This stance against firms such as Milbank, which recently employed former SEC enforcement leader Gurbir S. Grewal, symbolizes a clear indication of Coinbase’s strategic pivot toward aligning with legal entities that share its values and vision.

Regulatory Overreach or Justifiable Enforcement?

Armstrong’s critique stems from his belief that the previous SEC administration, under Gary Gensler’s leadership, engaged in actions that unlawfully targeted the cryptocurrency sector while offering little regulatory clarity. This claim of “unlawful” actions raises the question: does stringent regulation equate to overreach, or is it a necessary control measure for a rapidly evolving market? The interpretation largely depends on one’s perspective on balance—where innovation meets regulation. Armstrong’s assertion that former SEC officials should be held accountable for such overreach reveals a growing sentiment in the industry; many believe that regulators must adapt to the unique characteristics of digital finance rather than impose traditional financial regulations that may not fully apply.

Armstrong’s directive to legal firms isn’t just a statement of discontent; it’s a rallying cry for the entire crypto industry to reevaluate associations that undermine their standing. By stating that any engagement with individuals tied to perceived ethical breaches will result in the loss of Coinbase as a client, Armstrong is exhibiting a broader demand for accountability and reform within the legal advisory space. The impact of such a sentiment could catalyze a shift in how legal firms approach their hiring processes, leading them to reconsider candidates who may be viewed negatively by innovative sectors like cryptocurrency.

While Armstrong emphasizes the importance of not “permanently canceling” individuals, his perspective is aligned with a growing frustration within the crypto community regarding the lack of consistent regulatory guidance. Legal uncertainty stifles innovation, which is why many advocates, including Armstrong, are calling for a more cooperative relationship with regulators. By advocating for clearer guidelines, the hope is to foster an environment where both industry growth and consumer protection can thrive.

As Armstrong leads Coinbase through turbulent waters, his admonitions point toward a fundamental shift in how the blockchain and financial ecosystems might coexist with regulatory frameworks. This shift is not merely an internal battle for headlines or clients, but rather a pivotal moment for the industry as it redefines its relationship with regulators and seeks to carve out a sustainable path forward. The landscape of cryptocurrency is changing, and Armstrong’s stance could pave the way for a more equitable and transparent future. As the crypto community rallies behind such bold initiatives, the call for accountability and reform resonates louder than ever.