Bitcoin’s remarkable ascent to an unprecedented price of $109,558 coinciding with the inauguration of President Donald Trump has left market participants eager to decipher the political undercurrents that may be fueling this digital gold rush. The speculation surrounding the establishment of a Strategic Bitcoin Reserve (SBR) could significantly alter the future landscape of cryptocurrency in the United States, but is this just an ephemeral trend, or does it signal a watershed moment for Bitcoin’s institutional acceptance?

Political events have historically had significant ramifications in financial markets—an influence that has become acutely pronounced with the rise of cryptocurrencies. Observers noted that Bitcoin’s new all-time high closely followed discussions around Trump potentially implementing an SBR through executive action. This development has been a hot topic among financial analysts for some time, and as soon as Polymarket, a crypto-focused prediction marketplace, reported a surge in the odds of such an initiative within Trump’s first 100 days in office, investor sentiment shifted dramatically.

The rapid ascendancy of Bitcoin’s price reflects this speculation, with many investors betting that the installation of a Bitcoin reserve could stabilize the asset’s volatile price movements and lend legitimacy to the cryptocurrency in the eyes of mainstream finance. This moment underscores the powerful interplay between political decisions and market dynamics, a relationship that could evolve into a consistent factor driving Bitcoin valuations.

Noteworthy personalities within the financial and political landscape are raising the profile of Bitcoin significantly. Influential advocates for Bitcoin, such as Senator Cynthia Lummis, have been vocal in championing regulatory frameworks to facilitate the digital currency’s growth. Lummis and her colleagues have articulated plans that include both an SBR and comprehensive digital asset legislation, hinting at an organized effort to position Bitcoin as an integral component of the U.S. financial system.

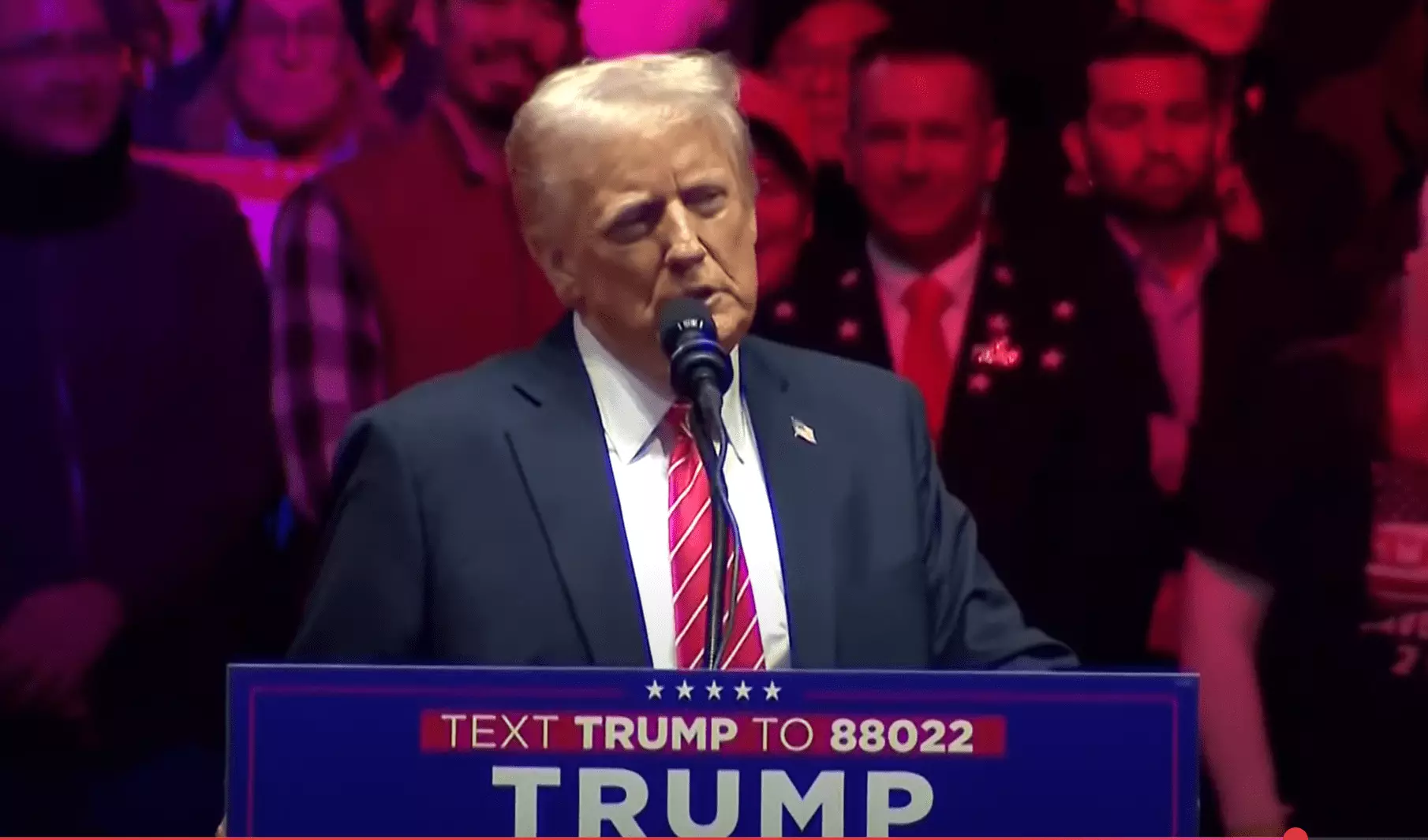

Additionally, MicroStrategy Chairman Michael Saylor’s involvement with Trump’s cabinet members emphasizes Bitcoin’s growing acceptance within elite circles. Photos shared on social media reveal a burgeoning camaraderie between the Trump administration and crypto enthusiasts. This alliance offers a glimpse into how cryptocurrency discussions are transforming from fringe topics into mainstream political dialogue, potentially impacting legislation that may favor Bitcoin’s expansion.

The burgeoning appreciation for Bitcoin could also lead to increased governmental oversight over the cryptocurrency sector, which is a double-edged sword. While it could inject more capital and stability into the market, it could also lead to regulations that may stifle innovation or disproportionally target smaller players in the space.

Market Reactions and Speculative Behavior

Market analysts are keenly observing the dynamics surrounding Bitcoin’s dramatic price fluctuations. Charles Edwards, CEO of Capriole Investments, has noted that Bitcoin’s fluctuations can be indicative of speculative behavior rather than rational market movements. The swift movements—first downwards, then back to new highs—are seen as signals of a volatile trading environment where emotions and speculation drive investor decisions. According to Edwards, when markets react strongly in one direction before reversing sharply, the second movement carries greater weight and could set the stage for new trends.

This means that speculators are not merely reacting to news but are also deeply influenced by the prevailing sentiment surrounding political developments. Investors appear to be increasingly aware that changes in government policy could directly impact the value of their holdings, further fuelling their willingness to engage in speculative trading.

A Cautious Outlook Amidst Euphoria

Despite the optimism surrounding possible government actions favoring Bitcoin, it is imperative to maintain a cautious perspective. The cryptocurrency market’s inherent volatility means that prices can pivot erratically, driven by factors ranging from global economic conditions to social media discourse.

While the implications surrounding an SBR are intriguing, and the prospect of an enthusiastic governmental endorsement of Bitcoin is alluring, uncertainties remain. Market participants must recognize that while the speculated influx of support might bolster Bitcoin’s standing, the realization of such initiatives would require time and coordination among various governmental agencies along with public backing, which is less predictable.

At this juncture, Bitcoin’s latest price surge stands as a testament to its transformative potential, but with that potential comes responsibility. As the political narrative unfolds, only time will unveil whether these developments signify the dawn of a new era for Bitcoin or simply a fleeting high in an inherently unstable marketplace.