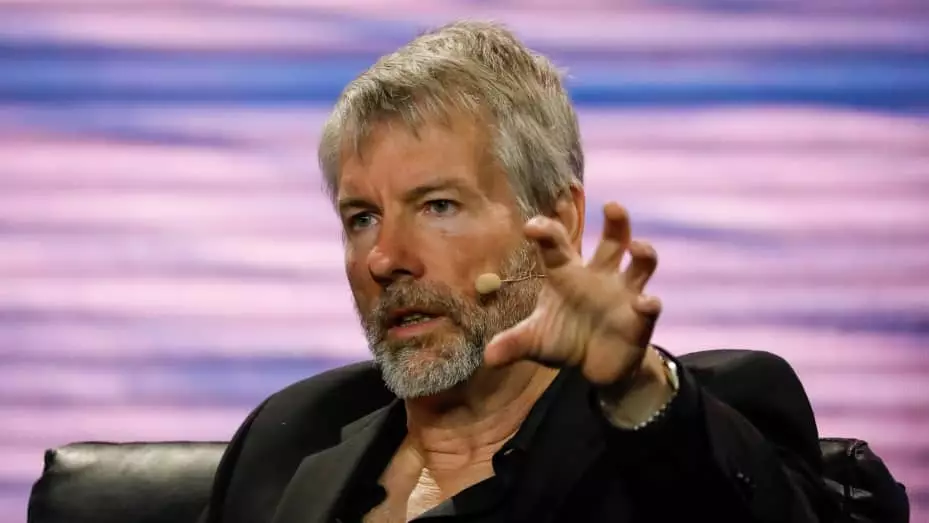

Michael Saylor, the co-founder and executive chairman of MicroStrategy, has made it clear that he and his company are committed to buying Bitcoin (BTC) indefinitely. Despite having an unrealized profit of approximately $4 billion from their BTC holdings, Saylor stated in a recent interview with Bloomberg that he has no intention of selling. He believes that BTC is the exit strategy and the most robust asset in the market.

Bitcoin’s Competition

While Bitcoin has established itself as a trillion-dollar asset, Saylor acknowledges that it is not a company but competes with other asset classes like gold and the S&P stock market index. According to him, there is not enough space in the capital structures of the top companies to accommodate large capital influxes. Bitcoin, therefore, is competing against gold, the S&P index, and real estate as a store of value.

Saylor argues that Bitcoin’s technical superiority to other asset classes will continue to attract capital inflows. He believes that BTC is superior to gold, the S&P index, and real estate, making it the clear winner among them. As a staunch supporter of Bitcoin, Saylor sees no reason to sell the leading digital asset to invest in inferior options.

Bitcoin ETFs and Future Demand

Two months ago, Saylor hailed the launch of spot Bitcoin exchange-traded funds (ETFs) as a significant development on Wall Street, comparing it to the creation of the S&P 500 fund. He began accumulating BTC in 2020, making MicroStrategy the first publicly traded company to hold Bitcoin. With a BTC stash of 190,000 coins acquired at an average price of $31,224 each, valued at over $10 billion currently, Saylor’s belief in Bitcoin’s future remains unwavering.

In December, Saylor predicted a surge in Bitcoin demand by 2024, a forecast that seems to be materializing. The growing demand for BTC from spot Bitcoin ETFs is nearly ten times higher than the current supply from miners. As Saylor and MicroStrategy continue their unwavering support for Bitcoin, the digital asset’s prominence in the financial world is set to increase further in the coming years.