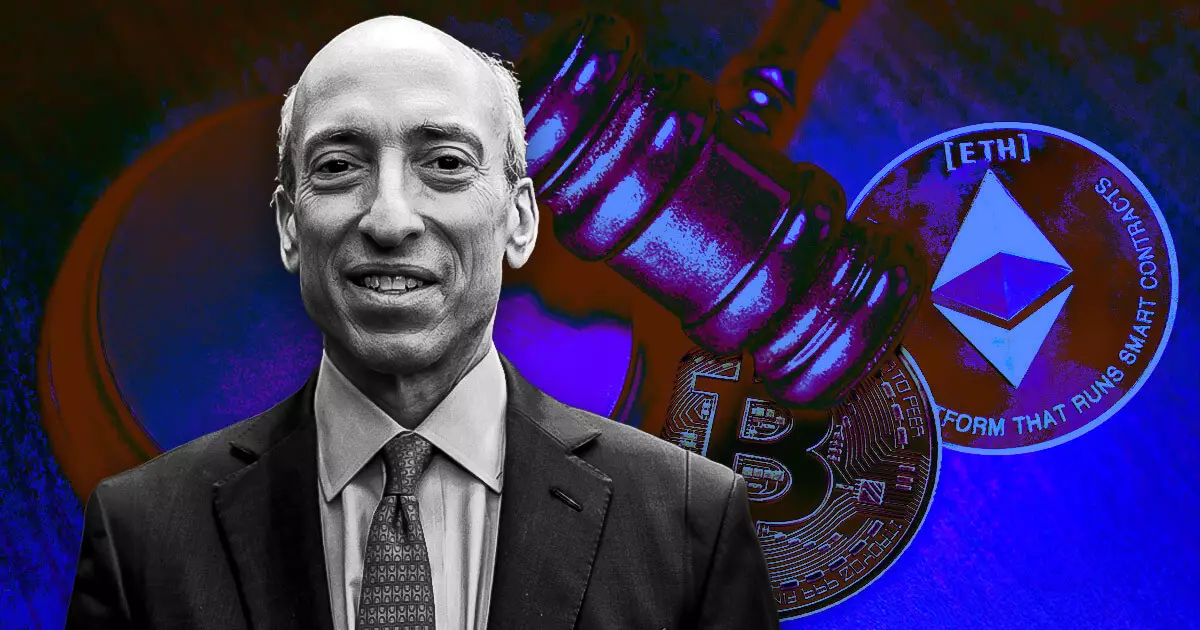

The recent news surrounding the US Securities and Exchange Commission (SEC) indicates a pivotal moment for both the Solana (SOL) ecosystem and the broader cryptocurrency market. Reports from Bloomberg suggest that the SEC plans to reject two recent applications for Solana-based spot exchange-traded funds (ETFs). Eric Balchunas, a senior analyst at Bloomberg ETF, characterized these decisions as a “parting gift” from the SEC Chair Gary Gensler, who is preparing to vacate his position in January 2025. This announcement has ignited discussions about the motivations behind the SEC’s actions and their implications for future crypto-related investment vehicles.

Impact of Leadership Changes

With Gensler’s tenure drawing to a close, the crypto landscape is rife with speculation regarding the direction the SEC may take under new leadership. Paul Atkins, recently confirmed by President-elect Donald Trump, is set to assume the role of SEC Chair. Analysts like Balchunas anticipate that Gensler’s replacements will re-evaluate the plethora of existing applications for crypto ETFs, including those tied to Solana. There’s an underlying hope among industry advocates that once Atkins steps into the role, the current aggressive regulatory stance may shift towards a more accommodating framework for digital assets.

The situation is further complicated by ongoing legal battles where assets like Solana are classified as securities. James Seyffart, another ETF analyst from Bloomberg, argues that approving Solana ETFs would contradict the SEC’s legal claims within various lawsuits asserting that SOL is a security. These contradictions create a complex environment — one that likely halts the approval process for these financial instruments until a clearer regulatory landscape is established. Seyffart places the potential approval timeline into a more distant future, initially projecting an August 2025 resolution as a generous estimate given current conditions.

The SEC’s maneuvers have sparked criticism from various figures within the crypto sector. Gabor Gurbacs, a former digital asset strategy director at VanEck, remarked on the anticipated departure of Gensler, implying that the current SEC is acting out of a desire to leave behind a controversial legacy. Adding to this narrative, the SEC’s recent legal actions — especially against major players like Binance — have been described as unnecessary and further contribute to the tumultuous climate in which crypto operates. The 81-page document filed by the SEC urging courts not to dismiss the lawsuit against Binance exemplifies this intensified scrutiny faced by digital asset platforms.

Future Prospects for Solana and the ETF Market

The road ahead for Solana ETFs remains uncertain. As applications sit “dead in the water,” the anticipation of regulatory clarity hangs in the balance. While industry leaders and investors watch closely, the shift in SEC leadership is an opportunity for rejuvenation and reevaluation within the crypto investment sphere. If Atkins embraces a different approach than Gensler, there might be a resurgence of interest in crypto ETF proposals, potentially reinvigorating the market for Solana and other digital assets. Until then, stakeholders must navigate the present reality of stringent regulatory oversight, awaiting a new chapter in cryptocurrency regulation that could define the industry’s future trajectory.