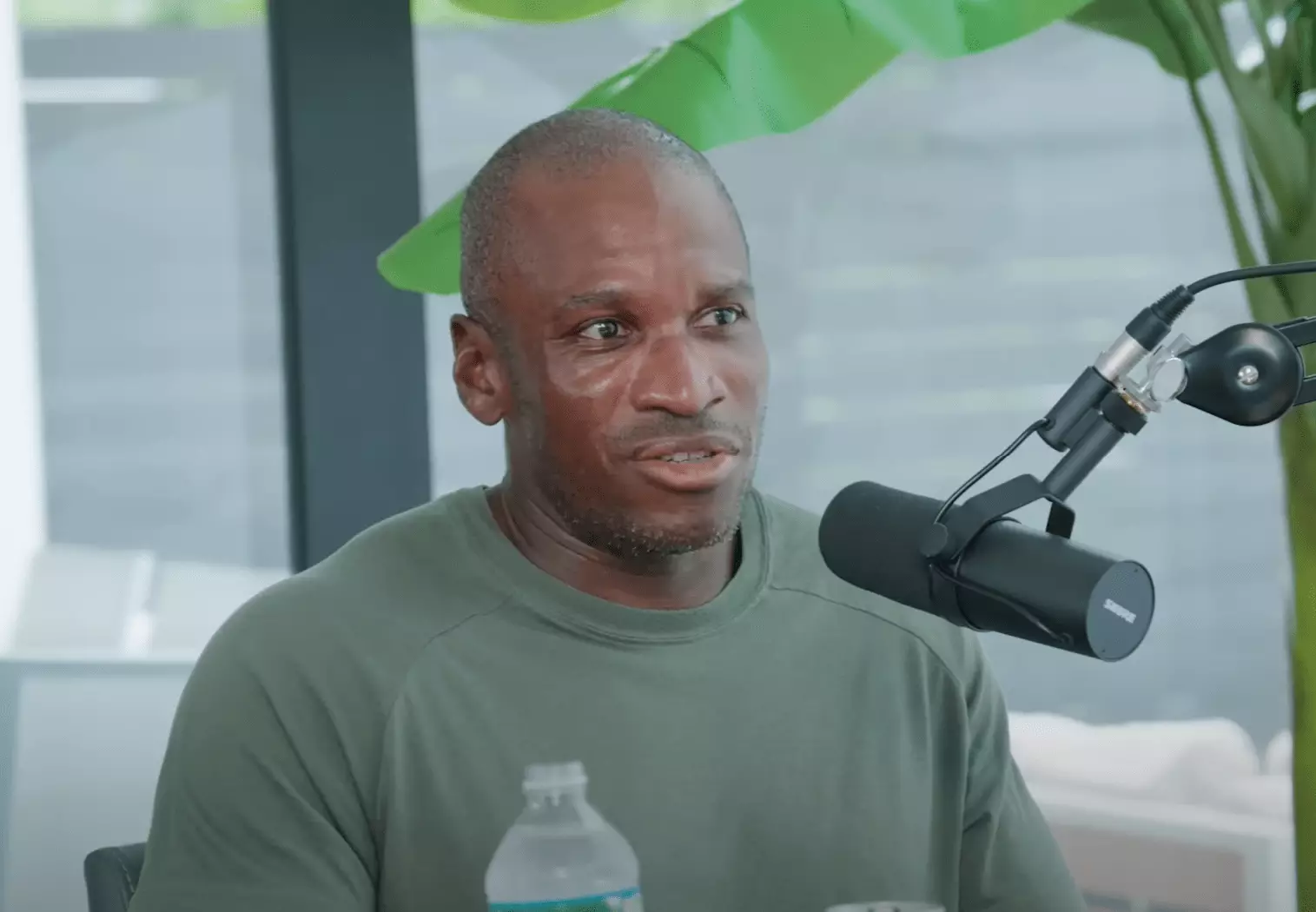

Cryptocurrency markets, particularly Bitcoin, are often characterized by their volatility and the multiplicity of factors influencing price movements. In light of recent sentiments expressed by Arthur Hayes, the Chief Investment Officer at Maelstrom and co-founder of BitMEX, there are significant implications for Bitcoin’s near-term performance. His recent essay titled “The Ugly” offers an analytical lens through which to view Bitcoin’s future trajectory, positing a potential pullback before returning to historic highs.

Hayes draws a vivid analogy between financial analysis and backcountry skiing on a dormant volcano. This imagery highlights the unexpected shifts in the market landscape that can lead to substantial losses if vigilance is not maintained. He likens his apprehensive feelings today to those experienced in late 2021, just before the crypto markets faced a sharp downturn. Such apprehensions stem from his close monitoring of macroeconomic signals—subtle movements in central bank policies, banking credit expansion, and the interconnectedness of asset prices which appear as red flags in the current financial climate.

Despite acknowledging current vulnerabilities, Hayes does not dismiss the overall bull cycle for Bitcoin. His prediction is that Bitcoin could drop to around $70,000 to $75,000 before making a formidable surge towards $250,000 by the year’s end. This assertion reflects a cautious optimism, underscoring the critical need to be attuned to market dynamics as they unfold. The malaise observed across equities and treasury markets, driven by lingering inflation and interest rate hikes, warrants a carefully calibrated investment approach as he navigates these turbulent waters.

In response to these market conditions, Hayes has emphasized a strategic hedging approach. His firm, Maelstrom, has adopted a ‘net long’ position while increasing its holdings of the USDe stablecoin, preparing to reinvest in Bitcoin should prices dip below his anticipated threshold. This decision serves a dual purpose—preserving capital to seize opportunities while simultaneously managing risk exposure in a shifting landscape. By estimating a 30% correction as plausible yet also recognizing the continuation of bullish trends, Hayes exemplifies the investor’s need to balance risk with reward.

Hayes further articulates that reactions among central banks, particularly the Federal Reserve, People’s Bank of China, and Bank of Japan, significantly contribute to Bitcoin’s potential volatility. Their movements towards monetary tightening can result in a chokehold on speculative capital, which could deter expansions in the cryptocurrency sphere. He posits that should treasury yields rise to the range of 5% to 6%, a storm of financial turmoil may ensue, with Bitcoin being drawn into the ensuing chaos. Such a scenario would necessitate the Federal Reserve to consider re-expanding its monetary base, creating further ripple effects.

The political backdrop plays an instrumental role in shaping monetary policy, and in Hayes’ analysis, the specter of Donald Trump and his past relationship with the Federal Reserve looms large. He contends that current political dynamics could trigger financial crises that compel the Fed’s intervention. This insight hinges on the Fed’s tendency to balance its dual mandate of price stability and maximum employment while contending with shifting political landscapes. The interconnectivity of financial policies under different presidential administrations can lead to unforeseen interventions or strategic maneuvers—conditions that shape the future trajectories of assets like Bitcoin.

Hayes also discusses the unexpected shift in China’s monetary strategy, emphasizing how geopolitical currents can dramatically alter liquidity environments. The People’s Bank of China’s abrupt pause on bond-buying illustrates the unpredictable nature of monetary policy, which can send shockwaves through global risk assets, including cryptocurrencies. Such external pressures augment the need for astute vigilance in investment decisions.

Understanding Bitcoin as a key indicator of broader market sentiment adds another layer of complexity to investor strategy. Hayes notes the rising correlation between Bitcoin and traditional risk assets like the Nasdaq 100, despite arguments for Bitcoin’s independence as a store of value. In a climate where fiat liquidity fluctuations dictate market behavior, Bitcoin appears as a barometer for upcoming declines in equities, signaling periods of distress that prompt a pullback in cryptocurrency values.

As authorities prepare to inject monetary stimulus to quell volatility, Hayes posits that Bitcoin would likely be the first asset to rebound, underscoring its role as both an indicator and participant in the broader financial ecosystem. Investors should, therefore, wield their discretion judiciously when navigating perceived probability rather than searching for certainties.

Bitcoin’s trajectory hinges upon a mosaic of macroeconomic forces, political considerations, and investor sentiment. Hayes’ insights compel investors to consider cautious yet responsive trading strategies that embrace the unpredictable nature of financial markets. With potential pullbacks looming, the onus remains on investors to fine-tune their approaches, using analysis and market intuition to forge pathways towards profitability amidst uncertainty. Ultimately, whether one raises capital or absorbs losses amidst volatility, navigating this intricate landscape requires an astute understanding of risk-reward dynamics.