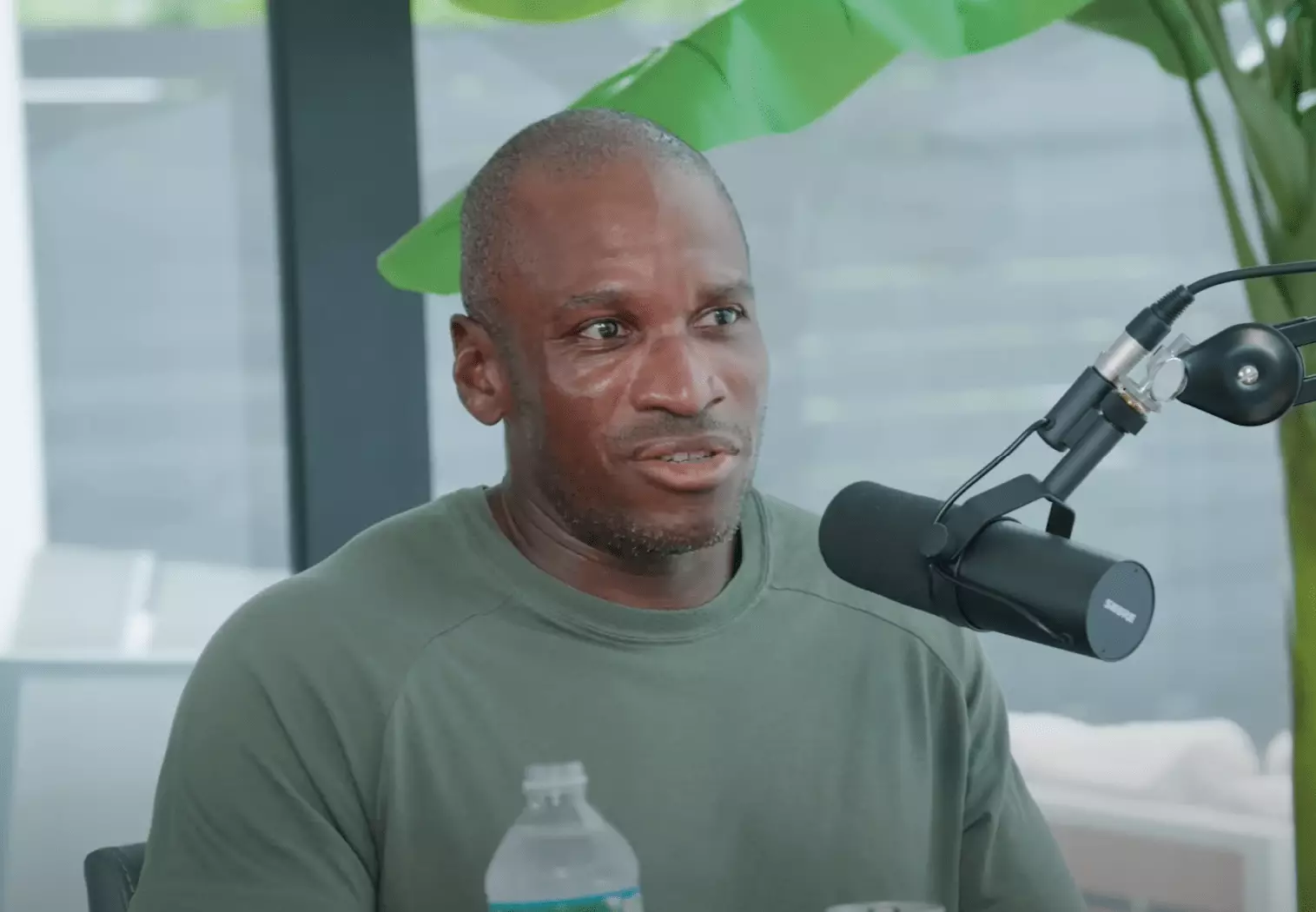

The cryptocurrency landscape has seen a significant surge in interest, particularly in Bitcoin, which many view as a hedge against inflation and economic uncertainty. Arthur Hayes, a prominent figure in the crypto world as the co-founder and former CEO of BitMEX, offers a provocative analysis that projects Bitcoin could reach valuations of $1 million. This forecast stems from an anticipated shift in U.S. economic policies, especially in the event of a Donald Trump presidency. Hayes’ insights prompt us to rethink not only Bitcoin’s potential but also the broader economic mechanisms that could drive such a meteoric rise.

Hayes introduces the concept of “American Capitalism with Chinese Characteristics,” suggesting that the United States is adopting economic strategies akin to those of modern China, where the government retains significant control over market outcomes. He posits that the U.S. economic system is transitioning away from classical capitalism toward a model focused on the preservation of power by the elite. This perspective highlights a crucial shift in the understanding of capitalism—whereby traditional notions of free markets are juxtaposed with state-led interventions that prioritize stability and control over pure economic growth.

Drawing historical parallels, Hayes references the economic reforms initiated by Deng Xiaoping in China, which were characterized by an embrace of market mechanisms while maintaining the Communist Party’s grip on power. He argues that similar dynamics are playing out in America, where the emphasis is less about ideology and more about maintaining authority through economic means, ultimately reshaping the political and economic landscape.

The response to the COVID-19 pandemic serves as a critical pivot point in Hayes’ analysis. There has been a shift from “trickle-down economics” to direct financial support for citizens, which he refers to as “QE for the poor.” This model contrasts sharply with the previous focus on enriching asset holders. The injection of liquidity into the economy through direct stimulus checks helped increase consumer spending, thereby nurturing economic activity in a previously stagnating environment.

Hayes suggests this shift may redefine how fiscal policy is implemented in the future, anticipating that similar strategies will continue under the next administration. He posits that the focus will be on re-shoring key industries to the United States, subsidizing select sectors to boost domestic production. Such government interventions, according to Hayes, are set to spur inflation—fueling concerns for those reliant on long-term savings and fixed-income investments.

Investment Strategy: Embracing Alternatives Amid Uncertainty

With inflation likely on the horizon, Hayes recommends investors consider Bitcoin and gold as alternatives to conventional saving methods. As he highlights, traditional asset classes might falter under the weight of expansive monetary policies, while Bitcoin—characterized by its limited supply—could emerge as a standout performer. This presents Bitcoin not merely as a speculative asset but as a viable means of preserving value in uncertain economic times.

Hayes emphasizes that the intrinsic nature of Bitcoin allows it to thrive in a scenario where fiat currencies depreciate due to rampant money printing and financial mismanagement. He illustrates this point through historical data depicting Bitcoin’s performance against traditional assets, indicating its resilience in times of economic turbulence.

An essential aspect of Hayes’ thesis revolves around potential regulatory changes that could impact monetary policy and banking practices in America. Specifically, he discusses the implications of exempting government securities from certain bank capital requirements, positing this could lead to “infinite QE.” Such developments would allow banks to amass large quantities of government debt, indirectly inflating the economy while potentially weakening the dollar.

Hayes warns that these dynamics could lead to significant upheaval in the financial sector, exacerbating the divide between wealth accumulation and socioeconomic stability. The increased bank credit flow, coupled with large-scale fiscal interventions, suggests that the economic landscape is ripe for transformative changes, where investors must act to secure their financial future.

In light of these evolving economic trends, Hayes’ conclusions urge investors to position themselves strategically, reinforcing the notion that traditional investment paradigms may no longer hold. As we navigate through these critical shifts, embracing innovative assets such as Bitcoin could become increasingly essential. The intersection of monetary policy, fiscal stimulus, and the potential for significant regulatory shifts creates an environment ripe for volatility, yet also ripe for unprecedented opportunities. As Bitcoin stands to gain traction as a safe haven in the face of economic uncertainty, understanding this new era of economic behavior will be pivotal for investors willing to adapt to the changing tides.