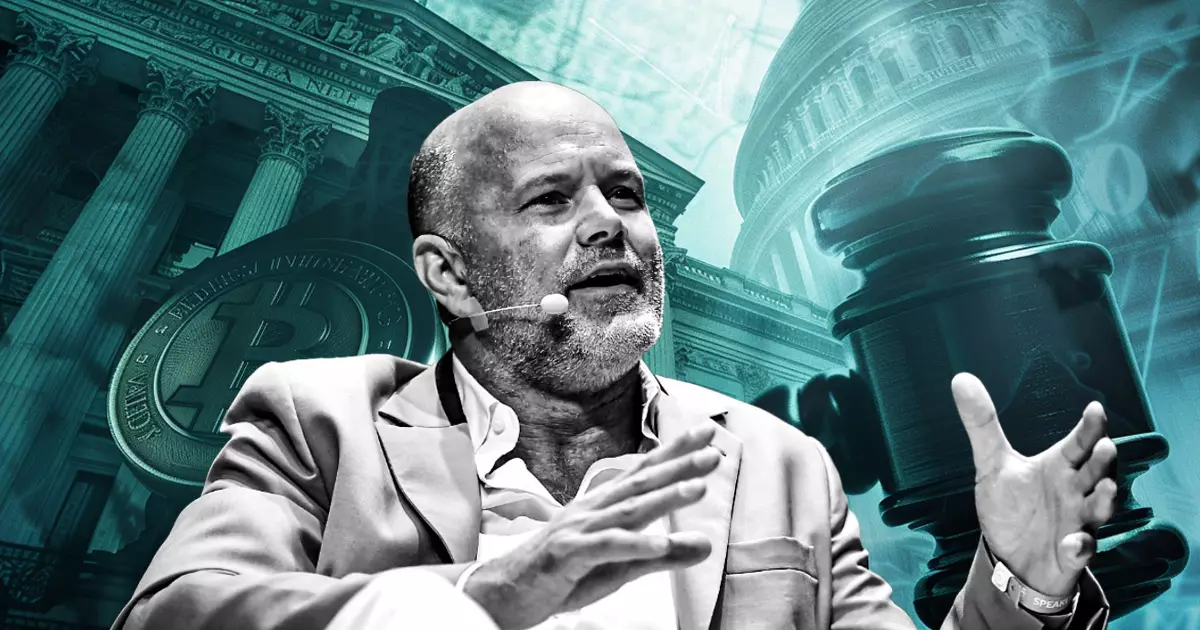

Galaxy Digital CEO Mike Novogratz believes that the future of the cryptocurrency sector in the US looks promising, regardless of the outcome of the 2024 presidential election. In a recent CNBC interview, Novogratz emphasized the importance of bipartisan support for crypto. He stated that it is crucial for both parties to back the industry to ensure its growth and development. According to Novogratz, having one party supporting crypto while the other opposes it will only hinder progress.

Despite some opposition from lawmakers such as Senator Elizabeth Warren, Novogratz noted that the majority of US politicians are leaning towards supporting innovation in the crypto industry. He highlighted that regulatory clarity has been lacking in the past, but there is now a noticeable shift towards a more favorable stance. Novogratz remains optimistic, stating that positive crypto legislation is inevitable, regardless of which party wins the next election.

The US political landscape is changing, with crypto gaining importance among voters. Recent surveys have shown that individuals who use cryptocurrencies are more likely to support politicians who are favorable towards the industry. This indicates a growing recognition of the role that crypto plays in the economy and the need for regulatory support to foster its growth.

Mike Novogratz also commented on Bitcoin’s recent market trends, pointing out its significant rise in price following the approval of Bitcoin ETFs. The cryptocurrency reached a new all-time high of over $73,000 in March. Novogratz predicts that Bitcoin will trade within the $55,000 to $73,000 range until there is further market-moving news. He believes that growth takes time and highlights Bitcoin’s impressive climb to its all-time high this year.

Novogratz continues to advocate for Bitcoin as a core component of investment portfolios, especially in light of the US government’s increasing debt and expenditure. He sees Bitcoin as a strategic asset that can provide stability and growth potential in uncertain economic times. Currently, Bitcoin is trading at around $62,000, reflecting a 9% decline over the past month but showing a 44% increase year-to-date and a 102% rise over the past year.

As of 12:47 am UTC on July 3, 2024, Bitcoin holds the top position in terms of market capitalization, with a value of $1.22 trillion and a 24-hour trading volume of $20.18 billion. The total cryptocurrency market is valued at $2.3 trillion, with a 24-hour volume of $51.21 billion. Bitcoin dominance is currently at 53.22%. This data reflects the strong presence of Bitcoin in the market and its influence on the overall cryptocurrency industry.

Mike Novogratz’s insights into the future of cryptocurrency regulation in the US provide valuable perspectives on the industry’s development and growth potential. The shift towards bipartisan support, along with positive market trends and advocacy for Bitcoin investment, indicate a favorable outlook for cryptocurrencies in the country. It is essential for policymakers to recognize the importance of regulatory clarity and innovation to ensure the continued success of the crypto sector.