The call for modification of Form S-1 by billionaire investor Mark Cuban has brought to light the challenges that token-based companies face when trying to register with the US Securities and Exchange Commission (SEC). This move comes after SEC Commissioner Mark Uyeda highlighted the inadequacies of the current approach to crypto disclosure filings.

Form S-1 is a crucial registration statement that domestic issuers must file with the SEC in order to offer new securities publicly. It includes vital company information such as business operations and risk factors. However, Uyeda pointed out that the requirements of Form S-1 do not fully align with the unique characteristics of most crypto issuers. This discrepancy makes it difficult for token-based companies to comply with the filing requirements.

Uyeda has proposed allowing variances for Form S-1 filings of crypto digital assets, similar to what is currently in place for funds and insurance products. This approach aims to provide a more tailored and relevant disclosure framework for crypto issuers. Uyeda believes that this could lead to offerings with more accurate and material information for investors, ultimately enhancing investor protection under the Securities Act.

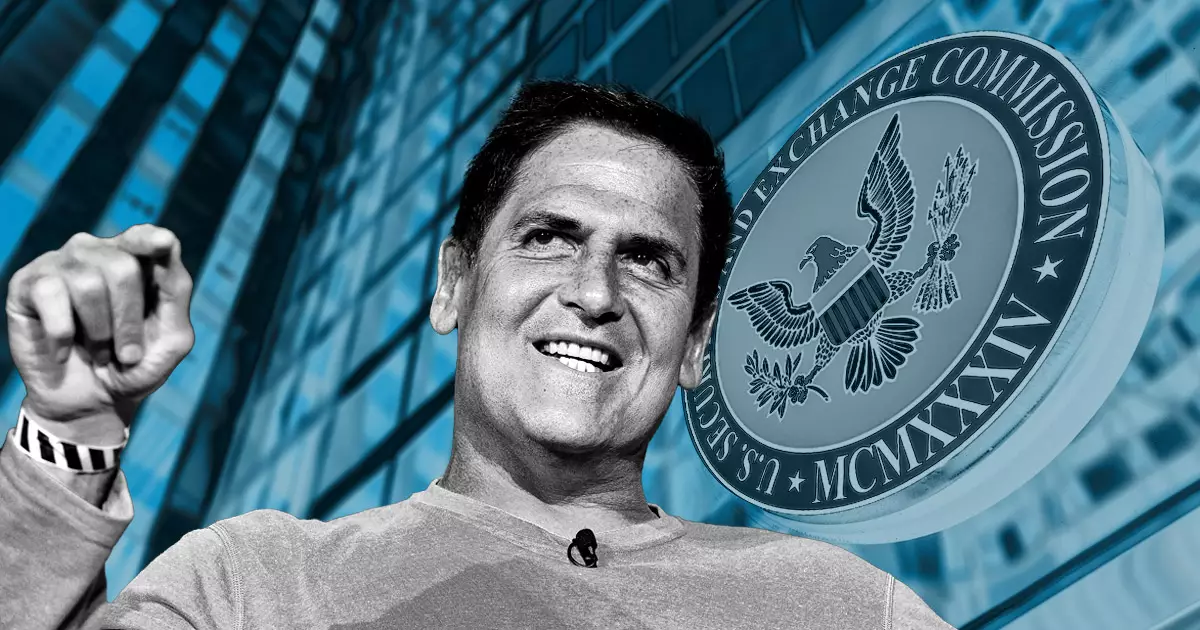

Billionaire investor Mark Cuban has expressed his support for Uyeda’s proposal, emphasizing the need for a more flexible approach to registration for token-based companies. Cuban highlighted that the current system forces crypto companies to fit into a mold that does not align with their unique characteristics, leading to registration challenges and hindering innovation in the industry. Similarly, the US Blockchain Association has lauded Uyeda’s statement, calling it a step in the right direction for the industry.

The modification of Form S-1 to accommodate the needs of token-based companies is crucial for fostering innovation and growth in the crypto industry. By allowing for variances in disclosure requirements, the SEC can create a more conducive environment for crypto issuers to register and operate while ensuring investor protection. It is essential for regulatory bodies to adapt to the evolving landscape of digital assets to support responsible growth and development in the industry.