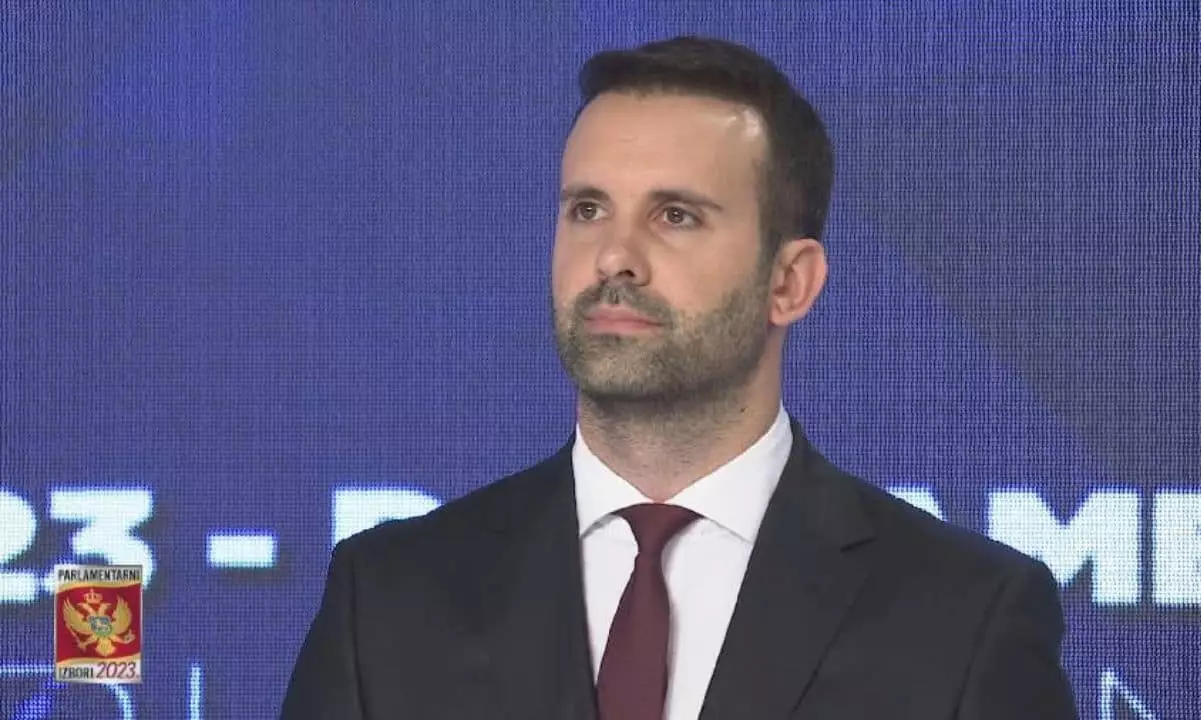

Reports reveal that Montenegrin Prime Minister Milojko Spajić made a significant investment in Terraform Labs back in April 2018, acquiring 750,000 Luna tokens for $75,000. This move positioned him as the 16th investor during the initial fundraising phase of the cryptocurrency project.

Unfortunately, Terraform Labs’ cryptocurrency project failed in 2022, resulting in losses exceeding $40 billion for investors worldwide. Despite initially acquiring Luna tokens at a low price of $0.10 each, Spajić faced potential losses nearing $90 million as the token’s value plummeted from $119 to nearly zero. The collapse of the Luna token led to significant financial implications for Spajić and other investors.

While financial experts speculate on the potential losses faced by Spajić, questions remain regarding his transparency about his investments. He reportedly did not disclose his ownership of Luna tokens to the Agency for the Prevention of Corruption, instead only declaring ownership of Bitcoin and other cryptocurrencies in his reports. It is unclear whether Spajić sought to recover his investment or pursue legal action against Terraform Labs and its founder, Do Kwon, for fraud.

In the aftermath of the Terraform Labs scandal, the Securities and Exchange Commission (SEC) secured a settlement requiring the company to pay $4.37 billion in fines and interest, while Do Kwon was mandated to contribute $200 million to an investor compensation fund. Kwon, who is currently detained in Montenegro, faces potential extradition to either the United States or South Korea for trial.

As the story of Montenegro’s Prime Minister’s involvement in the cryptocurrency world unfolds, it serves as a cautionary tale about the risks associated with early investments in volatile markets. The lack of transparency, legal ramifications, and devastating losses underscore the need for thorough due diligence and accountability in the digital asset space.