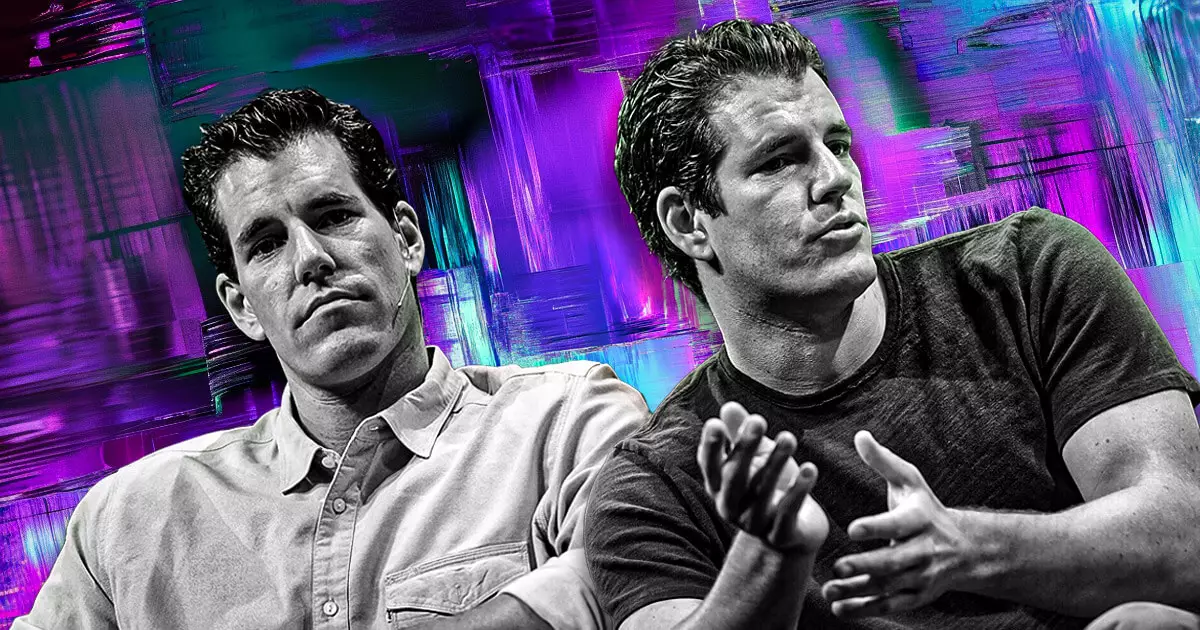

In a controversial move, Gemini, one of the leading cryptocurrency exchanges in the United States, has declared a halt on hiring graduates and interns from the Massachusetts Institute of Technology (MIT). This decision comes shortly after MIT’s reappointment of former US Securities and Exchange Commission (SEC) Chair Gary Gensler as a Professor of Practice, a move that has ignited intense debate within the cryptocurrency community. The Winklevoss twins, co-founders of Gemini, have articulated their discontent through social media platforms, illustrating the broader disconnect between traditional finance and the burgeoning world of cryptocurrency.

Gary Gensler’s departure from the SEC left a significant impact on the cryptocurrency landscape. Known for his stringent regulatory measures, many in the crypto industry have perceived his policies as stifling innovation and growth. His recent re-engagement with MIT, where he will focus on significant subjects like artificial intelligence, fintech, and public policy, raises questions among industry stakeholders. Critics argue that Gensler’s history of regulatory overreach directly contradicts the principles of innovation and disruption that define the cryptocurrency sector.

Gemini’s announcement reflects a palpable tension between traditional academic institutions and the rapidly evolving cryptocurrency environment. The Winklevoss twins have made it clear that as long as MIT continues its partnership with Gensler, they will seek talent elsewhere, which could signify a larger trend of alienation within the industry.

The reaction to Gemini’s stance has reverberated throughout the crypto community. Influential figures like Matt Huang from Paradigm have encouraged professionals affiliated with MIT to engage with the institution over these developments. This dialogue highlights a potential rift not only between major exchanges and academic institutions but also within the broader cryptocurrency ecosystem. Industry leaders are becoming increasingly vocal about their discontent, possibly paving the way for a more unified response against perceived threats to innovation.

Additionally, Caitlin Long, CEO of Custodia Bank, sparked further speculation about a possible paradigm shift in how firms engage with academia. Her questions regarding the broader industry movement reflect a growing sentiment that companies may begin distancing themselves from universities that maintain ties with regulators viewed unfavorably by the crypto sector.

As the crypto industry continues to mature, the implications of Gemini’s decision could lead to lasting consequences for MIT’s relationship with the sector. This situation encapsulates a deeper struggle over the future of regulatory frameworks and innovation within emerging technologies. If influential firms like Gemini refuse to collaborate with institutions closely associated with figures like Gensler, it may provoke a reevaluation of educational partnerships across the industry.

Gemini’s vow to boycott MIT graduates is more than just a hiring decision; it represents a critical juncture for the evolving dialogue between the cryptocurrency sector and traditional academic institutions. As the rift deepens and conversations unfold, this episode may serve as a catalyst for broader changes in how these sectors interact, ultimately shaping the future landscape of innovation in finance.