Recent reports reveal that the US Security and Exchange Commission’s (SEC) Office of Inspector General (OIG) is currently investigating cryptocurrency-related financial conflicts of interest. Empower Oversight, an accountability group, brought attention to the matter, highlighting concerns regarding the failures of the SEC’s Ethics Office and a former official, William Hinman. Allegations suggest that Hinman engaged in activities where he had a financial stake, particularly in delivering a speech favoring specific digital assets, such as Ethereum, over others in the market.

Critics from the Ripple XRP community raised valid concerns about Hinman’s speech, claiming that it unfairly favored Ethereum and potentially provided an advantage in the market. Empower Oversight presented documentation indicating the involvement of key figures from Ethereum, including co-founders Joseph Lubin and Vitalik Buterin, in drafting the contentious speech. Additionally, the group highlighted that Hinman had disregarded instructions not to meet with specific individuals, such as his former employer Simpson Thacher, a member of the Ethereum Enterprise Alliance (EEA).

Following Hinman’s departure from the SEC in December 2020 and his return to Simpson Thacher as a partner, the SEC filed a lawsuit against Ripple, alleging that XRP was an unregistered security. Empower Oversight formally brought these concerns to the OIG’s attention in May 2022. The group has since threatened the SEC with legal action if they do not provide information regarding the investigations by a specified date. Despite filing a Freedom of Information Act (FOIA) in May 2023, Empower Oversight claims that the SEC has failed to provide any updates on the case.

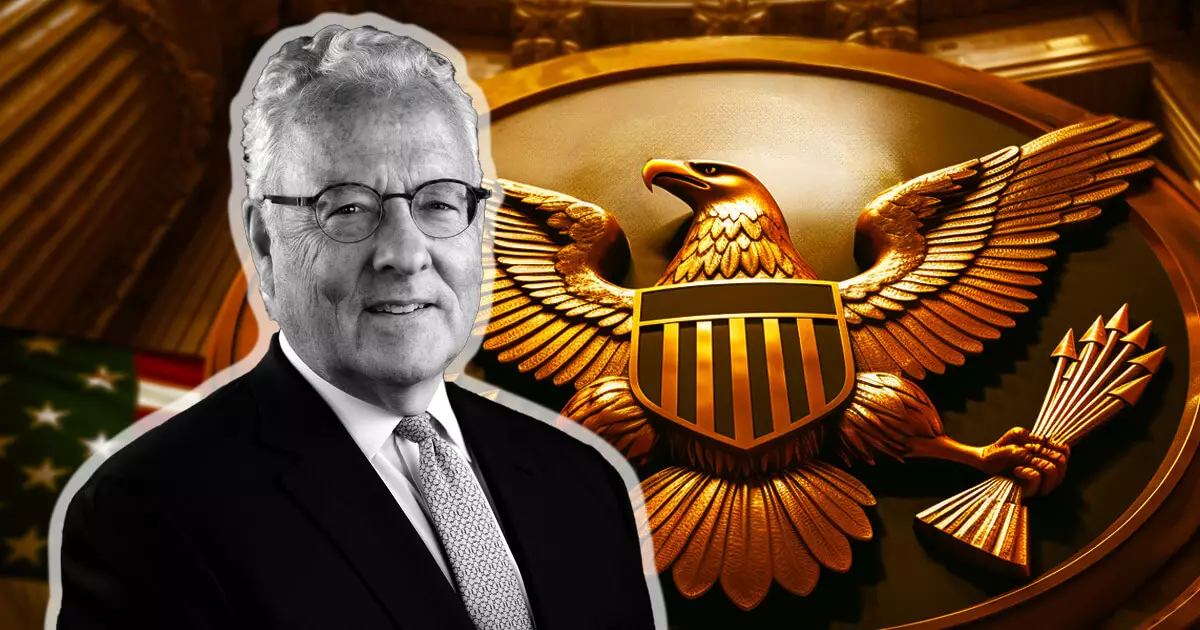

Tristan Leavitt, president of Empower Oversight, expressed some optimism about the situation, stating that the ongoing stonewalling from the SEC may be attributed to a legitimate inquiry by the inspector general, which is nearing completion. The group continues to push for transparency and accountability within the SEC, emphasizing the importance of addressing conflicts of interest and ethical lapses in regulatory matters concerning cryptocurrency. As the investigation unfolds, the outcome remains uncertain, leaving the cryptocurrency community eager for answers and potential reforms within the SEC.