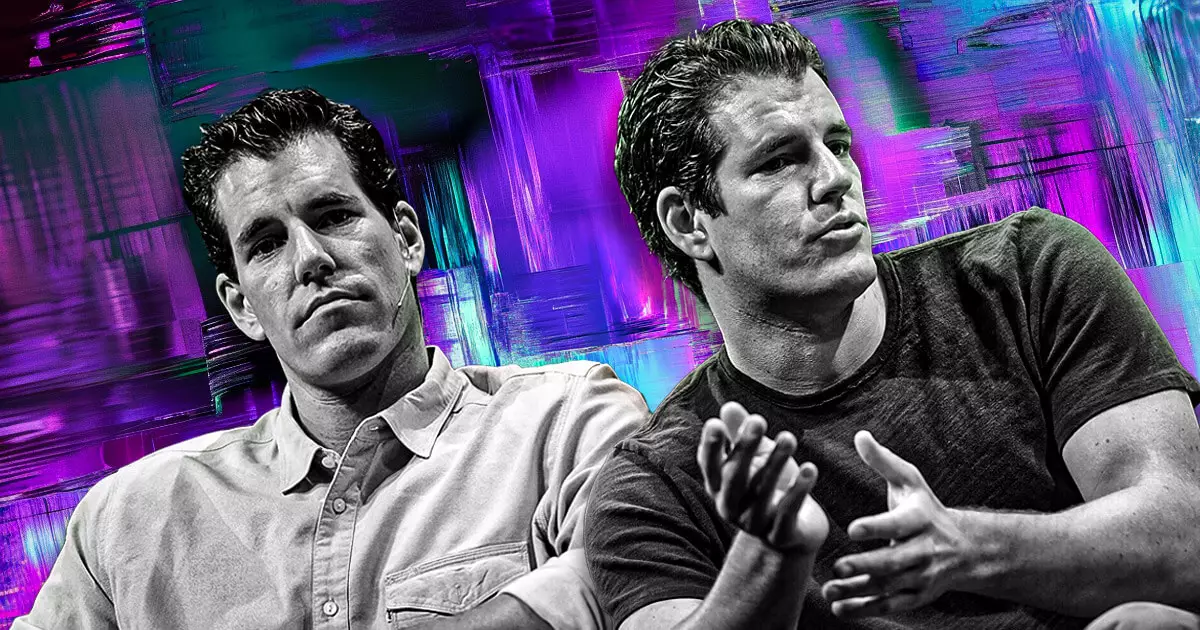

Gemini, the cryptocurrency exchange founded by the Winklevoss twins, is contemplating an initial public offering (IPO) in the near future, as indicated by a recent Bloomberg News report. While discussions are ongoing with potential advisers to facilitate this public listing, it is pivotal to note that no formal decision has been reached. This potential IPO reflects broader trends within the cryptocurrency industry, where increasing regulatory clarity and a perceived supportive financial environment may encourage several companies to go public.

Political Climate and Its Impact on Crypto Firms

The favorable stance of the previous Trump administration towards cryptocurrencies has positioned the market for potential growth, particularly regarding both institutional and retail investments. James Seyffart, a Bloomberg ETF analyst, suggests that the ongoing supportive measures will prompt more crypto companies, including Gemini, to consider public listings in the coming years. Particularly noteworthy is the engagement of the Winklevoss twins, who reportedly donated Bitcoin to Trump’s campaign, emphasizing their alignment with a pro-crypto political framework. This move underscores how political dynamics can significantly influence corporate strategies within the volatile crypto space.

Gemini’s pursuit of an IPO comes during a turbulent period marked by multiple regulatory hurdles. Recently, the company faced legal repercussions when it settled a lawsuit with the Commodity Futures Trading Commission (CFTC) for $5 million, following allegations of misleading regulators while trying to launch a U.S.-regulated Bitcoin futures contract. Such legal battles raise critical questions about the sustainability of business models in a heavily scrutinized environment. More than just the IPO strategy, Gemini is actively reevaluating its geographical operations, deciding to exit the Canadian market amidst growing regulatory challenges. This pivot aligns with a broader trend where several crypto firms, including Bybit and Binance, have similarly retracted their operations from specific jurisdictions.

Conversely, Gemini is not entirely retracting from global markets; it recently acquired a license in Singapore to provide cross-border money transfer and digital payment services. This move illustrates a strategic emphasis on jurisdictions that welcome crypto innovation. Singapore has emerged as a hub for cryptocurrency firms striving for regulatory clarity, with various entities like OKX and Coinbase eyeing expansion in the city-state. This juxtaposition of withdrawing from certain markets while investing in others highlights a dual strategy aimed at bolstering resilience and agility in an evolving landscape.

As the cryptocurrency ecosystem continues to navigate through regulatory challenges and potential market volatility, Gemini’s contemplation of an IPO serves as a pivotal moment not just for the company but for the crypto sector as a whole. The firm’s ongoing strategic adjustments, coupled with a pro-crypto political atmosphere and a potential shift towards greater global acceptance, suggest an optimistic future. However, the reality remains that the industry is fraught with uncertainties, making it imperative for all stakeholders to stay adaptable and vigilant in capitalizing on emerging opportunities and effectively managing risks.