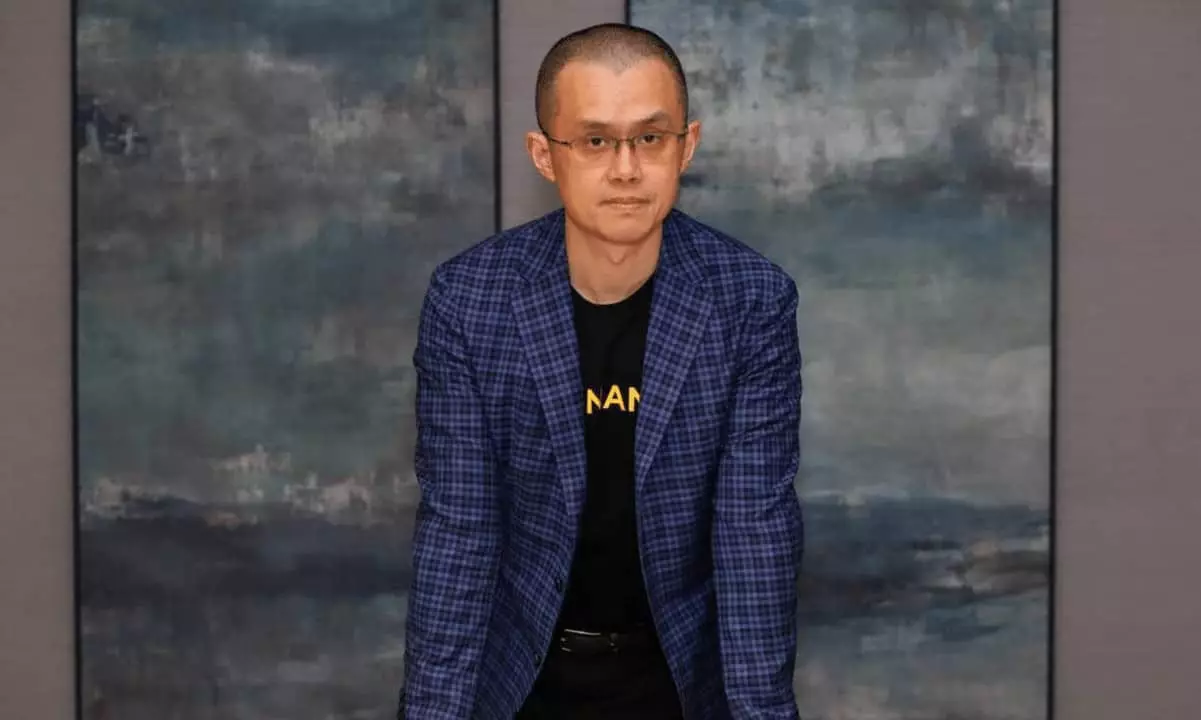

In a remarkable transaction for the cryptocurrency market, the AVA token of Travala saw an astonishing increase of over 300% within a single day. This upward momentum followed a significant endorsement by Changpeng Zhao, the former CEO of Binance, whose support has proven to be a powerful catalyst for investment dynamics. Zhao’s recent social media post brought renewed attention and credibility to the blockchain-based travel platform, stirring excitement among both potential and current investors.

The surge in AVA’s value coincided with Travala’s announcement of reaching an annual revenue milestone of $100 million—a notable increase from last year’s $59.6 million. This financial success is largely attributed to the rising acceptance of cryptocurrencies for travel-related expenses, enabling clients to book flights and accommodations using digital currencies. Travala’s proactive strategy also involves diversifying its treasury reserves by investing in both AVA and Bitcoin, echoing the approach popularized by MicroStrategy’s Michael Saylor.

Zhao’s announcement not only highlighted Binance’s historical investment in Travala but also underscored the potential for continued growth in the platform. Zhao is widely recognized in the cryptocurrency ecosystem as a pivotal figure, often referred to as one of the “OGs of Crypto.” His endorsement effectively acts as a trust signal, suggesting that Travala is a worthy investment opportunity. This perception sent ripples through the market, reflected in the explosion of AVA-related social media activity, as noted by projections from the platform LunarCrush. With over 1.3 million views on Zhao’s post, investor curiosity peaked, contributing to a seismic rise in AVA’s trading volume, which surged past $890 million—an astonishing increase of 28,436% in just 24 hours.

At its peak, the token experienced a monumental shift from approximately $0.75 to a high of $3.38. By the end of the trading cycle, AVA had maintained a remarkable valuation increase of around 286.6% over a week and an extraordinary 541% over the month leading up to this endorsement. The token’s market capitalization soared to nearly $172 million, placing it prominently at rank #445 among cryptocurrencies by market cap, showcasing its resilience in a predominantly declining market in which many assets, including Ethereum-related tokens, have faced a downturn.

Travala’s strategies reveal its commitment to harnessing the evolving landscape of cryptocurrency for practical applications in travel. The uptick in the AVA token’s price indicates a growing acceptance and interest in blockchain solutions across traditional sectors. As more individuals and companies consider adopting cryptocurrencies for everyday transactions, platforms like Travala may lead the charge in transforming consumer habits in travel.

Moreover, Zhao’s endorsement could serve as a model for other crypto-centric enterprises to explore partnerships and strategies that promote sustainability and growth in the current market climate. As other cryptocurrencies face challenges, the response to Travala’s AVA token demonstrates the importance of community sentiment, influential endorsements, and strategic financial maneuvers in building a resilient business model within the volatile world of digital currencies. As the cryptocurrency landscape continues to evolve, stakeholders will be watching closely to see whether this price surge marks the onset of sustained growth for Travala or remains a fleeting moment of volatility.